Asked by Kiran Rawal on Jul 29, 2024

Verified

Tipp Topp Company reports the following for the month of June. Units‾ Unit Cost ‾ Total Cost ‾ June 1 Inventory 300$5$1,50012 Purchase 45062,70023 Purchase 7507.605,70030 Inventory 180\begin{array}{rlcr}& \underline{\text { Units}}& \underline{\text { Unit Cost }}& \underline{\text { Total Cost }}\\\text { June } 1 \text { Inventory } & 300 & \$ 5 & \$ 1,500 \\12 \text { Purchase } & 450 & 6 & 2,700 \\23 \text { Purchase } & 750 & 7.60 & 5,700 \\30 \text { Inventory } & 180 & &\end{array} June 1 Inventory 12 Purchase 23 Purchase 30 Inventory Units300450750180 Unit Cost $567.60 Total Cost $1,5002,7005,700

Instructions

(a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO and (2) LIFO.

(b) Compute the cost of the ending inventory and the cost of goods sold using the average-cost method.

FIFO

"First In, First Out," an inventory valuation method where goods first acquired are the first sold or used, affecting cost of goods sold and inventory value.

LIFO

An inventory valuation method that assumes the last items of inventory purchased are the first ones sold ("Last In, First Out").

Average-Cost Method

An inventory costing method that assigns a cost to inventory items based on the average cost of all similar goods available during the period.

- Identify the value of ending inventory and the cost of goods sold by employing assorted inventory costing strategies.

Verified Answer

\quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad FIFO\mathrm{FIFO}FIFO Beginning inventory (300×$5) $1,500 Purchases June 12(450×$6)$2,700 June 23(750×$7.60) 5,7008,400 Cost of goods available for sale 9,900 Less: Ending inventory (160×$7.60) 1,216‾ Cost of goods sold $9,694‾\begin{array}{lrr} \text {Beginning inventory \( (300 \times \$ 5) \) } &&\$1,500\\ \text { Purchases } &\\ \text { June \( 12(450 \times \$ 6) \)} &\$2,700\\ \text { June \( 23(750 \times \$ 7.60) \) } &5,700&8,400\\ \text { Cost of goods available for sale } &&9,900\\ \text { Less: Ending inventory \( (160 \times \$ 7.60) \) } &&\underline{1,216}\\ \text { Cost of goods sold } &&\underline{\$9,694}\\\end{array}Beginning inventory (300×$5) Purchases June 12(450×$6) June 23(750×$7.60) Cost of goods available for sale Less: Ending inventory (160×$7.60) Cost of goods sold $2,7005,700$1,5008,4009,9001,216$9,694

\quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad LIFO \text { LIFO } LIFO

Cost of goods available for sale $9,900 Less: Ending inventory (160×$5)800‾ Cost of goods sold $9,100‾\begin{array}{lrr}\text { Cost of goods available for sale }&&\$9,900 \\\text { Less: Ending inventory }(160 \times \$ 5) && \underline{800 }\\\text { Cost of goods sold }&& \underline{\$ 9,100 }\\\end{array} Cost of goods available for sale Less: Ending inventory (160×$5) Cost of goods sold $9,900800$9,100

(b)

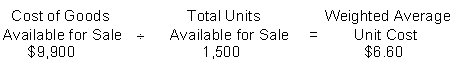

12(450×$6) 12(450 \times \$ 6) 12(450×$6) } &\$2,700\\ \text { June 23(750×$7.60) 23(750 \times \$ 7.60) 23(750×$7.60) } &5,700&8,400\\ \text { Cost of goods available for sale } &&9,900\\ \text { Less: Ending inventory (160×$7.60) (160 \times \$ 7.60) (160×$7.60) } &&\underline{1,216}\\ \text { Cost of goods sold } &&\underline{\$9,694}\\ \end{array} \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \text { LIFO } \begin{array}{lrr} \text { Cost of goods available for sale }&&\$9,900 \\ \text { Less: Ending inventory }(160 \times \$ 5) && \underline{800 }\\ \text { Cost of goods sold }&& \underline{\$ 9,100 }\\ \end{array} (b) \begin{array}{lr} \text { Ending inventory }(160 \times \$ 6.60) & \$ 1,056 \\ \text { Cost of goods sold }(1,340 \times \$ 6.60) & 8,844 \end{array}" class="answers-bank-image d-inline" rel="preload" >

12(450×$6) 12(450 \times \$ 6) 12(450×$6) } &\$2,700\\ \text { June 23(750×$7.60) 23(750 \times \$ 7.60) 23(750×$7.60) } &5,700&8,400\\ \text { Cost of goods available for sale } &&9,900\\ \text { Less: Ending inventory (160×$7.60) (160 \times \$ 7.60) (160×$7.60) } &&\underline{1,216}\\ \text { Cost of goods sold } &&\underline{\$9,694}\\ \end{array} \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \text { LIFO } \begin{array}{lrr} \text { Cost of goods available for sale }&&\$9,900 \\ \text { Less: Ending inventory }(160 \times \$ 5) && \underline{800 }\\ \text { Cost of goods sold }&& \underline{\$ 9,100 }\\ \end{array} (b) \begin{array}{lr} \text { Ending inventory }(160 \times \$ 6.60) & \$ 1,056 \\ \text { Cost of goods sold }(1,340 \times \$ 6.60) & 8,844 \end{array}" class="answers-bank-image d-inline" rel="preload" >Ending inventory (160×$6.60)$1,056 Cost of goods sold (1,340×$6.60)8,844\begin{array}{lr}\text { Ending inventory }(160 \times \$ 6.60) & \$ 1,056 \\\text { Cost of goods sold }(1,340 \times \$ 6.60) & 8,844\end{array} Ending inventory (160×$6.60) Cost of goods sold (1,340×$6.60)$1,0568,844

Learning Objectives

- Identify the value of ending inventory and the cost of goods sold by employing assorted inventory costing strategies.

Related questions

The Following Information Is Available for Clancy Company Assume That ...

Ford Co Uses a Periodic Inventory System Instructions Compute the ...

Norris Company Uses the Perpetual Inventory System and Had the ...

The Following Information Is Available for Clancy Company Assume That ...

Shellhammer Company's Inventory Records Show the Following Data for the ...