Asked by MIRTEMUR SHAKIROV on Jun 12, 2024

Verified

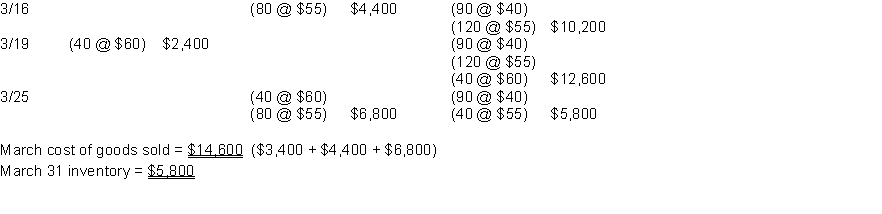

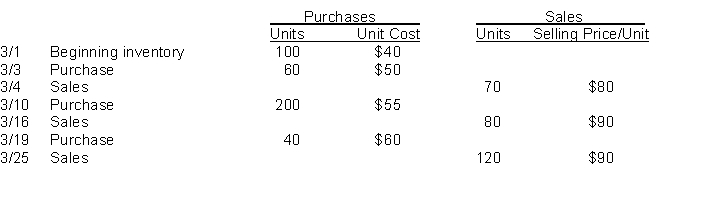

Norris Company uses the perpetual inventory system and had the following purchases and sales during March.  Instructions

Instructions

Using the inventory and sales data above calculate the value assigned to cost of goods sold in March and to the ending inventory at March 31 using (a) FIFO and (b) LIFO.

FIFO

First-In, First-Out, an inventory valuation method where the first items placed in inventory are the first sold.

LIFO

An inventory valuation approach called Last In, First Out dictates that the newest items in inventory are the first to be accounted for as sold or used.

Cost of Goods Sold

Cost of Goods Sold represents the direct costs attributable to the production of the goods sold by a company, including material, labor, and overhead costs.

- Ascertain the worth of closing stock and the expense of sold goods through varied inventory valuation approaches.

Verified Answer

Learning Objectives

- Ascertain the worth of closing stock and the expense of sold goods through varied inventory valuation approaches.

Related questions

Lester Company Sells Many Products ...

Shellhammer Company's Inventory Records Show the Following Data for the ...

The Following Information Is Available for Clancy Company Assume That ...

Pearl Company Uses the Periodic Inventory System to Account for ...

Tipp Topp Company Reports the Following for the Month of ...