Asked by Carol Jasso on Jul 13, 2024

Verified

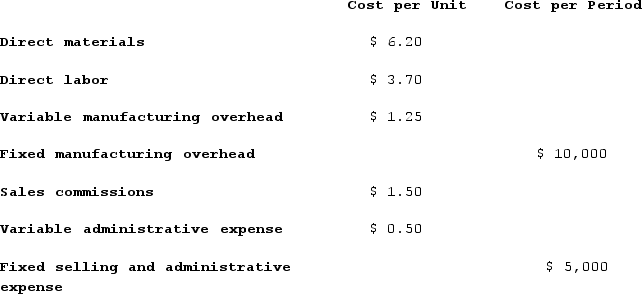

Bressette Corporation has provided the following information:  For financial reporting purposes, the total amount of product costs incurred to make 5,000 units is closest to:

For financial reporting purposes, the total amount of product costs incurred to make 5,000 units is closest to:

A) $55,750

B) $65,750

C) $10,000

D) $70,750

Product Costs

The direct costs associated with the creation of a product, including materials, labor, and manufacturing overhead.

Financial Reporting

The act of creating declarations that unveil a corporation's economic situation to its executives, shareholders, and regulatory agencies.

- Calculate the combined product and period expenses for creating financial reports.

Verified Answer

DW

Deloris WilliamsJul 15, 2024

Final Answer :

B

Explanation :

The provided information does not give the exact product costs incurred to make 5,000 units. However, we can use the following formula to calculate the product cost:

Product cost = Direct materials + Direct labor + Manufacturing overhead

Without additional information about direct materials and direct labor, we can use the manufacturing overhead rate to estimate the total product cost. The manufacturing overhead rate is calculated by dividing the estimated total manufacturing overhead by the estimated total amount of the allocation base.

We are given the following information in the question:

Estimated total manufacturing overhead: $24,500

Estimated total allocation base: 1,000 direct labor hours

Therefore, the manufacturing overhead rate is:

Manufacturing overhead rate = $24,500 ÷ 1,000 direct labor hours = $24.50 per direct labor hour

To make 5,000 units, let's assume that Bressette Corporation needs 10,000 direct labor hours (2 hours of direct labor per unit). Therefore, the manufacturing overhead cost for 10,000 direct labor hours is:

Manufacturing overhead cost = 10,000 direct labor hours × $24.50 per direct labor hour = $245,000

Thus, the total product cost incurred to make 5,000 units is:

Product cost = Direct materials + Direct labor + Manufacturing overhead

Product cost = Unknown + Unknown + $245,000

Product cost is closest to $245,000 or $49 per unit.

To eliminate choices (C) and (D), we can see that both are much higher than $49 per unit. Therefore, the best choice is (B) $65,750, which is closest to $49 per unit × 5,000 units.

Product cost = Direct materials + Direct labor + Manufacturing overhead

Without additional information about direct materials and direct labor, we can use the manufacturing overhead rate to estimate the total product cost. The manufacturing overhead rate is calculated by dividing the estimated total manufacturing overhead by the estimated total amount of the allocation base.

We are given the following information in the question:

Estimated total manufacturing overhead: $24,500

Estimated total allocation base: 1,000 direct labor hours

Therefore, the manufacturing overhead rate is:

Manufacturing overhead rate = $24,500 ÷ 1,000 direct labor hours = $24.50 per direct labor hour

To make 5,000 units, let's assume that Bressette Corporation needs 10,000 direct labor hours (2 hours of direct labor per unit). Therefore, the manufacturing overhead cost for 10,000 direct labor hours is:

Manufacturing overhead cost = 10,000 direct labor hours × $24.50 per direct labor hour = $245,000

Thus, the total product cost incurred to make 5,000 units is:

Product cost = Direct materials + Direct labor + Manufacturing overhead

Product cost = Unknown + Unknown + $245,000

Product cost is closest to $245,000 or $49 per unit.

To eliminate choices (C) and (D), we can see that both are much higher than $49 per unit. Therefore, the best choice is (B) $65,750, which is closest to $49 per unit × 5,000 units.

Learning Objectives

- Calculate the combined product and period expenses for creating financial reports.

Related questions

A Partial Listing of Costs Incurred During March at Febbo ...

For Financial Reporting Purposes, the Total Amount of Product Costs ...

Learned Corporation Has Provided the Following Information ...

Asplund Corporation Has Provided the Following Information ...

Saxbury Corporation's Relevant Range of Activity Is 3,000 Units to ...