Asked by Ashley Fondeur on Jun 10, 2024

Verified

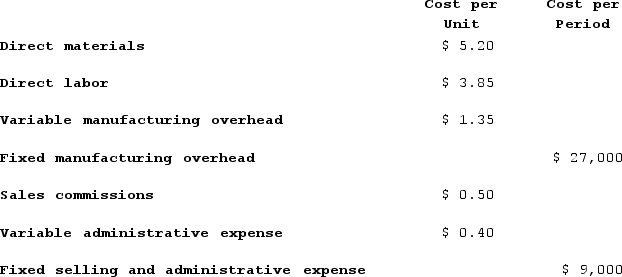

Learned Corporation has provided the following information:

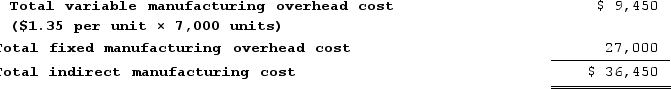

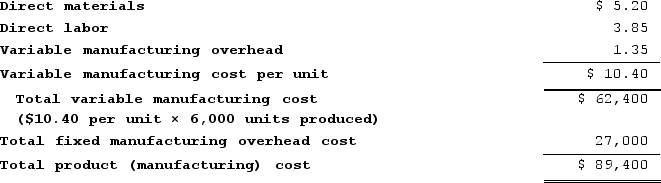

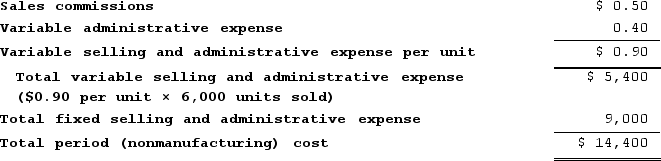

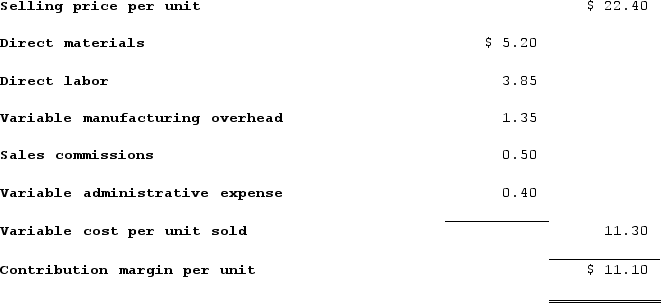

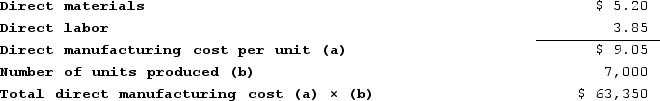

Required:a. For financial reporting purposes, what is the total amount of product costs incurred to make 6,000 units?b. For financial reporting purposes, what is the total amount of period costs incurred to sell 6,000 units?c. If the selling price is $22.40 per unit, what is the contribution margin per unit sold? (Round your answer to 2 decimal places.)d. If 7,000 units are produced, what is the total amount of direct manufacturing cost incurred?e. If 7,000 units are produced, what is the total amount of indirect manufacturing costs incurred?

Required:a. For financial reporting purposes, what is the total amount of product costs incurred to make 6,000 units?b. For financial reporting purposes, what is the total amount of period costs incurred to sell 6,000 units?c. If the selling price is $22.40 per unit, what is the contribution margin per unit sold? (Round your answer to 2 decimal places.)d. If 7,000 units are produced, what is the total amount of direct manufacturing cost incurred?e. If 7,000 units are produced, what is the total amount of indirect manufacturing costs incurred?

Product Costs

The total costs directly involved in manufacturing a product, including material, labor, and overhead expenses.

Period Costs

Expenses that are not directly tied to the production process and are typically accounted for as expenses in the period they are incurred.

Contribution Margin

The amount by which sales revenue exceeds variable costs, contributing to the coverage of fixed costs and profit generation.

- Master the conceptual difference between costs incurred for products and costs allocated to periods.

- Estimate the total expenditure on product and period based on the quantity of units manufactured or marketed.

- Compute the amounts for variable and fixed costs, both per unit and in totality.

Verified Answer

Learning Objectives

- Master the conceptual difference between costs incurred for products and costs allocated to periods.

- Estimate the total expenditure on product and period based on the quantity of units manufactured or marketed.

- Compute the amounts for variable and fixed costs, both per unit and in totality.

Related questions

Saxbury Corporation's Relevant Range of Activity Is 3,000 Units to ...

Mary Tappin, an Assistant Vice President at Galaxy Toys, Was ...

Streif Incorporated a Local Retailer, Has Provided the Following Data ...

Morrisroe Corporation Has Provided the Following Information ...

Boersma Sales, Incorporated a Merchandising Company, Reported Sales of 7,100 ...

b.

b. c.

c. d.

d. e.

e.