Asked by Eugene Dioso on Jun 28, 2024

Verified

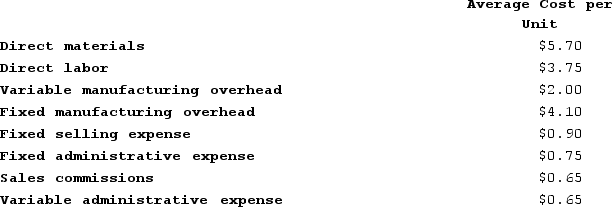

Saxbury Corporation's relevant range of activity is 3,000 units to 7,000 units. When it produces and sells 5,800 units, its average costs per unit are as follows:

Required:a. For financial reporting purposes, what is the total amount of product costs incurred to make 5,800 units?b. For financial reporting purposes, what is the total amount of period costs incurred to sell 5,800 units?c. If 6,800 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places.)d. If 6,800 units are sold, what is the total amount of variable costs related to the units sold?e. If 6,800 units are produced, what is the average fixed manufacturing cost per unit produced? (Round "Per unit" answer to 2 decimal places.)f. If 6,800 units are produced, what is the total amount of fixed manufacturing cost incurred?g. If 6,800 units are produced, what is the total amount of manufacturing overhead cost incurred? What is this total amount expressed on a per unit basis? (Round "Per unit" answer to 2 decimal places.)h. If the selling price is $23.20 per unit, what is the contribution margin per unit sold? (Round "Per unit" answer to 2 decimal places.)i. If 4,800 units are produced, what is the total amount of direct manufacturing cost incurred?j. If 4,800 units are produced, what is the total amount of indirect manufacturing cost incurred?k. What incremental manufacturing cost will the company incur if it increases production from 5,800 to 5,801 units? (Round "Per unit" answer to 2 decimal places.)

Required:a. For financial reporting purposes, what is the total amount of product costs incurred to make 5,800 units?b. For financial reporting purposes, what is the total amount of period costs incurred to sell 5,800 units?c. If 6,800 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places.)d. If 6,800 units are sold, what is the total amount of variable costs related to the units sold?e. If 6,800 units are produced, what is the average fixed manufacturing cost per unit produced? (Round "Per unit" answer to 2 decimal places.)f. If 6,800 units are produced, what is the total amount of fixed manufacturing cost incurred?g. If 6,800 units are produced, what is the total amount of manufacturing overhead cost incurred? What is this total amount expressed on a per unit basis? (Round "Per unit" answer to 2 decimal places.)h. If the selling price is $23.20 per unit, what is the contribution margin per unit sold? (Round "Per unit" answer to 2 decimal places.)i. If 4,800 units are produced, what is the total amount of direct manufacturing cost incurred?j. If 4,800 units are produced, what is the total amount of indirect manufacturing cost incurred?k. What incremental manufacturing cost will the company incur if it increases production from 5,800 to 5,801 units? (Round "Per unit" answer to 2 decimal places.)

Product Costs

Costs that are incurred to create a product that includes direct materials, direct labor, and manufacturing overhead.

Period Costs

Expenses that are not directly tied to the production process and are expensed in the period they are incurred.

Variable Cost

Expenses that change in proportion to the activity of a business such as costs of goods sold, raw materials, and labor expenses.

- Familiarize yourself with the differentiation between the financial charges of products and those of periods.

- Evaluate the total product and period financial outlays as per the number of units produced or sold.

- Analyze the per-unit cost and total expenditure for variable and fixed costs.

Verified Answer

![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624b_c4f6_bf83_e57aef14ede6_TB8314_00.jpg) b.

b.![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624b_ec07_bf83_d5505c458578_TB8314_00.jpg) c.

c.![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624b_ec08_bf83_2d72a604b789_TB8314_00.jpg) d.

d.![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624b_ec09_bf83_affcee274f20_TB8314_00.jpg) e.

e.![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624b_ec0a_bf83_e1bd2fc0c6c3_TB8314_00.jpg) *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f.

*The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f.![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624b_ec0b_bf83_75ff7f44946d_TB8314_00.jpg) g.

g.![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624c_131c_bf83_9f52f9904586_TB8314_00.jpg) *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h.

*The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h.![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624c_131d_bf83_75e46727c741_TB8314_00.jpg) i.

i.![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624c_131e_bf83_81bd1190b6a6_TB8314_00.jpg) j.

j.![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624c_131f_bf83_c3e4e1aa147a_TB8314_00.jpg) *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.

*The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624c_1320_bf83_fd93a5044427_TB8314_00.jpg)

Learning Objectives

- Familiarize yourself with the differentiation between the financial charges of products and those of periods.

- Evaluate the total product and period financial outlays as per the number of units produced or sold.

- Analyze the per-unit cost and total expenditure for variable and fixed costs.

Related questions

Morrisroe Corporation Has Provided the Following Information ...

Mary Tappin, an Assistant Vice President at Galaxy Toys, Was ...

Streif Incorporated a Local Retailer, Has Provided the Following Data ...

Asplund Corporation Has Provided the Following Information ...

Boersma Sales, Incorporated a Merchandising Company, Reported Sales of 7,100 ...