Asked by Jayson Sta Cruz on May 07, 2024

Verified

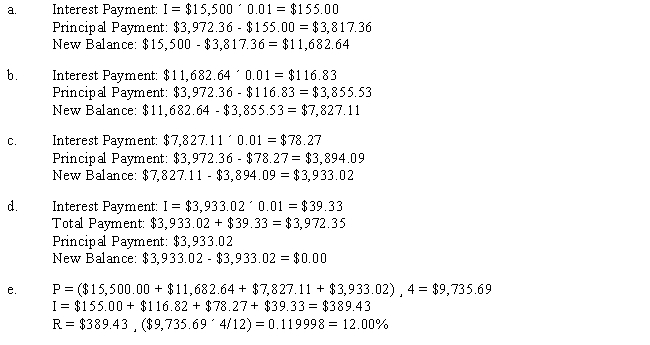

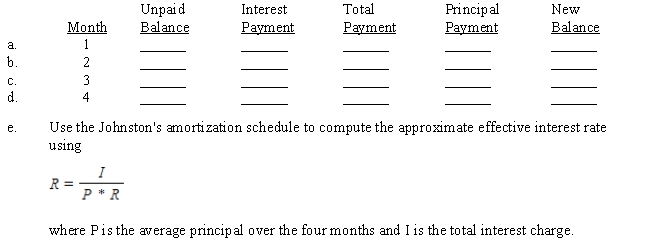

Bill and Dick Johnston wanted to borrow $15,500 for four months for their business. A local bank offered to make a loan to be amortized at 12%. Using Table 14-1, the first three monthly payments are $3,972.36 each. (The last payment may be slightly different.) Complete the amortization schedule and solve the effective rate problem.

Amortized

Refers to the gradual reduction of a debt over time by paying regular installments that cover both interest and principal.

Amortization Schedule

a table detailing each periodic payment on an amortizing loan, showing the amount of principal and the amount of interest that comprise each payment so that the loan will be paid off by the end of its term.

Effective Rate

The actual interest rate earned or paid on an investment, loan, or other financial product, taking into account the effect of compounding.

- Understand the principles of amortization for both housing and business loans.

- Develop proficiency in completing loan amortization schedules for different loan scenarios.

- Competency in calculating effective interest rates for various loan repayment plans.

Verified Answer

GN

Learning Objectives

- Understand the principles of amortization for both housing and business loans.

- Develop proficiency in completing loan amortization schedules for different loan scenarios.

- Competency in calculating effective interest rates for various loan repayment plans.