Asked by Nurul Ainaa on Apr 26, 2024

Verified

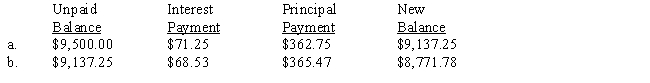

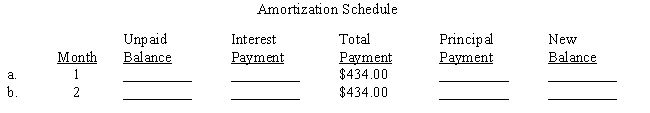

Tanya Cordobes borrowed $9,500 from a bank. The loan was amortized over two years. Tanya made equal monthly payments of $434.00, which included interest on the unpaid balance of 0.75% per month (9% annually). Complete the first two months of the amortization schedule.

Amortization Schedule

An Amortization Schedule is a table detailing each periodic payment on an amortizing loan, showing amounts paid to principal and interest.

Interest on Unpaid Balance

Interest charged on the portion of a loan or credit card balance that has not been paid off within the agreed period.

Equal Monthly Payments

Regular payments of the same amount made over a set period to repay a loan or mortgage.

- Examine the outcomes of decisions involving loans subject to amortization, including monthly repayments and interest compounding.

- Evaluate and accomplish the preparation of amortization schedules for loans that feature steady monthly payments.

Verified Answer

Learning Objectives

- Examine the outcomes of decisions involving loans subject to amortization, including monthly repayments and interest compounding.

- Evaluate and accomplish the preparation of amortization schedules for loans that feature steady monthly payments.

Related questions

Marilyn Post Borrowed $10,000 from Her Bank, Which Amortized the ...

$15,000 (Present Value) Is Borrowed Today at 12% Compounded Quarterly ...

Jerry Isaacs Went to His Credit Union to Inquire About ...

Brendina Gillespie Wanted to Buy a New Car ...

Judy Baker Borrowed $5,000 and Agreed to Amortize the Loan ...