Asked by Kaylan Ealey on May 10, 2024

Verified

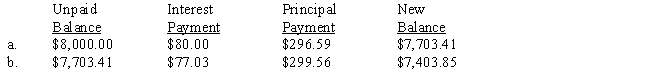

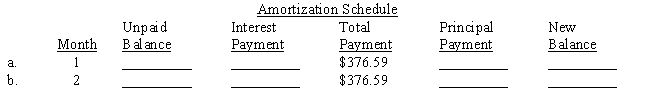

Jerry Isaacs went to his credit union to inquire about borrowing $8,000. The credit union told him they could amortize an $8,000 loan over two years with 24 payments of $376.59. The interest rate would be 1% per month on the unpaid balance (12% annual rate). Complete the first two months of the amortization schedule.

Amortization Schedule

A table detailing each periodic payment on a loan over time, breaking down the amounts going towards principal and interest.

Interest Rate

The proportion of a loan that is charged as interest to the borrower, typically expressed as an annual percentage.

Monthly Payments

Regular payments made every month, often in the context of loans or leasing agreements.

- Assess the implications of financial choices concerning loans that are amortized with monthly installments and rates of interest that compound over time.

- Examine and finalize amortization schedules for loans that have consistent monthly installments.

Verified Answer

CB

Learning Objectives

- Assess the implications of financial choices concerning loans that are amortized with monthly installments and rates of interest that compound over time.

- Examine and finalize amortization schedules for loans that have consistent monthly installments.