Asked by Haley Adams on Jul 19, 2024

Verified

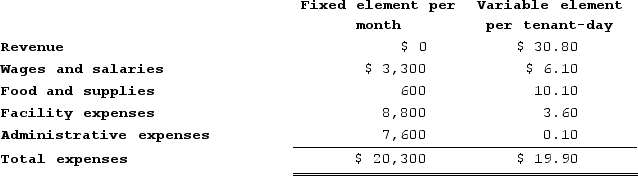

Bernes Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During October, the kennel budgeted for 2,700 tenant-days, but its actual level of activity was 2,720 tenant-days. The kennel has provided the following data concerning the formulas to be used in its budgeting:  The activity variance for net operating income in October would be closest to:

The activity variance for net operating income in October would be closest to:

A) $2,328 F

B) $218 U

C) $218 F

D) $2,328 U

Activity Variance

The discrepancy observed between a business's estimated activities costs or resources and the actual expenses or usage.

Net Operating Income

Represents the total profit of a business after operating expenses are subtracted from gross profit.

- Learn how to determine and decode activity variances in different expense categories.

- Gain insight into the effect that variations in activity have on net operating income.

Verified Answer

PS

Pavneet SinghJul 21, 2024

Final Answer :

C

Explanation :

To calculate the activity variance for net operating income, we need to first calculate the flexible budget for the actual level of activity:

Flexible budget = Budgeted variable cost per unit x Actual units of activity

From the given information, we know that the kennel budgeted for 2,700 tenant-days, with a budgeted variable cost of $28 per tenant-day, which gives a total budgeted variable cost of:

$28 x 2,700 = $75,600

Using the formula for flexible budget, we can calculate the expected variable cost for the actual level of activity (2,720 tenant-days):

Flexible budget = $28 x 2,720 = $76,160

Now, we can calculate the activity variance as:

Activity variance = Actual variable cost - Flexible budget

The actual variable cost is not given, but we know that it must be greater than the flexible budget, since the actual level of activity (2,720) is greater than the budgeted level of activity (2,700). Therefore, the activity variance will be unfavorable (i.e. negative).

To estimate the activity variance, we can use the given information about the fixed costs and contribution margin:

- Budgeted fixed costs = $48,000

- Budgeted contribution margin per unit = $25

- Actual units sold = 2,720

Using this information, we can calculate the flexible budget for net operating income:

Flexible budget for net operating income = Budgeted fixed costs + (Budgeted contribution margin per unit x Actual units of activity)

Flexible budget for net operating income = $48,000 + ($25 x 2,720) = $119,000

Now, we can estimate the actual net operating income by multiplying the actual level of activity (2,720 tenant-days) by the contribution margin per unit:

Actual net operating income = Actual units of activity x Contribution margin per unit - Fixed costs

Actual net operating income = (2,720 x $25) - $48,000 = $32,000

Finally, we can calculate the activity variance for net operating income as:

Activity variance = Actual net operating income - Flexible budget for net operating income

Activity variance = $32,000 - $119,000 = -$87,000

Since the actual net operating income is lower than the flexible budget, the activity variance is unfavorable. Therefore, the closest answer choice is C) $218 F.

Flexible budget = Budgeted variable cost per unit x Actual units of activity

From the given information, we know that the kennel budgeted for 2,700 tenant-days, with a budgeted variable cost of $28 per tenant-day, which gives a total budgeted variable cost of:

$28 x 2,700 = $75,600

Using the formula for flexible budget, we can calculate the expected variable cost for the actual level of activity (2,720 tenant-days):

Flexible budget = $28 x 2,720 = $76,160

Now, we can calculate the activity variance as:

Activity variance = Actual variable cost - Flexible budget

The actual variable cost is not given, but we know that it must be greater than the flexible budget, since the actual level of activity (2,720) is greater than the budgeted level of activity (2,700). Therefore, the activity variance will be unfavorable (i.e. negative).

To estimate the activity variance, we can use the given information about the fixed costs and contribution margin:

- Budgeted fixed costs = $48,000

- Budgeted contribution margin per unit = $25

- Actual units sold = 2,720

Using this information, we can calculate the flexible budget for net operating income:

Flexible budget for net operating income = Budgeted fixed costs + (Budgeted contribution margin per unit x Actual units of activity)

Flexible budget for net operating income = $48,000 + ($25 x 2,720) = $119,000

Now, we can estimate the actual net operating income by multiplying the actual level of activity (2,720 tenant-days) by the contribution margin per unit:

Actual net operating income = Actual units of activity x Contribution margin per unit - Fixed costs

Actual net operating income = (2,720 x $25) - $48,000 = $32,000

Finally, we can calculate the activity variance for net operating income as:

Activity variance = Actual net operating income - Flexible budget for net operating income

Activity variance = $32,000 - $119,000 = -$87,000

Since the actual net operating income is lower than the flexible budget, the activity variance is unfavorable. Therefore, the closest answer choice is C) $218 F.

Learning Objectives

- Learn how to determine and decode activity variances in different expense categories.

- Gain insight into the effect that variations in activity have on net operating income.

Related questions

Rogstad Corporation Manufactures and Sells a Single Product ...

Fager Clinic Uses Client-Visits as Its Measure of Activity ...

Neubert Corporation Manufactures and Sells a Single Product ...

Chimilio Clinic Uses Client-Visits as Its Measure of Activity ...

Moncrief Corporation Bases Its Budgets on Machine-Hours ...