Asked by Rabina Pandey on Jul 26, 2024

Verified

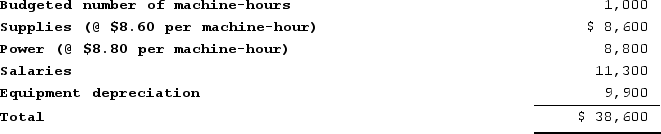

Moncrief Corporation bases its budgets on machine-hours. The company's static planning budget for July appears below:  Actual results for the month were:

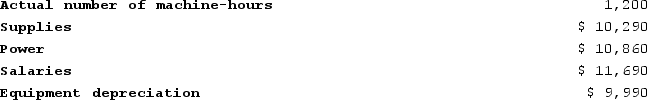

Actual results for the month were:

The spending variance for equipment depreciation in the flexible budget performance report for the month should be:

The spending variance for equipment depreciation in the flexible budget performance report for the month should be:

A) $1,890 U

B) $90 F

C) $90 U

D) $1,890 F

Equipment Depreciation

The process of allocating the cost of tangible assets over their useful lives, representing wear and tear on equipment.

Machine-hours

The measurement of the amount of time machines are used in the manufacturing process, rephrased as "The cumulative operational time of machines for production."

Spending Variance

The difference between the budgeted or planned amount of expenditure and the actual amount spent.

- Examine the fiscal outcomes by applying flexible budgeting techniques.

- Differentiate between expenditures and activity variances.

Verified Answer

Flexible Budget Amount for Equipment Depreciation = Budgeted Machine Hours x Budgeted Depreciation Rate per Machine Hour = 8,400 x $0.30 = $2,520

Actual Amount Spent on Equipment Depreciation = Actual Machine Hours x Actual Depreciation Rate per Machine Hour = 9,000 x $0.27 = $2,430

Spending Variance = Flexible Budget Amount - Actual Amount Spent = $2,520 - $2,430 = $90 U

Therefore, the spending variance for equipment depreciation in the flexible budget performance report for the month is $90 U, so the best choice is C.

Learning Objectives

- Examine the fiscal outcomes by applying flexible budgeting techniques.

- Differentiate between expenditures and activity variances.

Related questions

Brong Corporation Is a Shipping Container Refurbishment Company That Measures ...

Laizure Clinic Uses Patient-Visits as Its Measure of Activity ...

Lasserre Clinic Uses Patient-Visits as Its Measure of Activity ...

Shaak Corporation Uses Customers Served as Its Measure of Activity ...

Vondran Clinic Uses Patient-Visits as Its Measure of Activity ...