Asked by Joshua Palesano on Jul 30, 2024

Verified

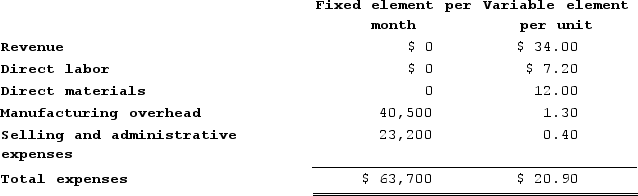

Rogstad Corporation manufactures and sells a single product. The company uses units as the measure of activity in its budgets and performance reports. During March, the company budgeted for 6,700 units, but its actual level of activity was 6,670 units. The company has provided the following data concerning the formulas to be used in its budgeting:  The activity variance for direct labor in March would be closest to:

The activity variance for direct labor in March would be closest to:

A) $2,406 U

B) $216 U

C) $216 F

D) $2,406 F

Activity Variance

The difference between the budgeted or planned level of activity or production and the actual level achieved.

Direct Labor

The labor costs directly attributed to the production of goods or services, such as wages paid to assembly line workers.

Budgeting

The process of creating a plan to spend your money, allocating financial resources to various activities, departments, or items over a particular period.

- Achieve fluency in the process of determining and deciphering variances in activity for different expenditure categories.

- Acknowledge the effects of differing activity levels on fixed and variable expenses.

Verified Answer

ZK

Zybrea KnightAug 02, 2024

Final Answer :

C

Explanation :

To calculate the activity variance for direct labor, we need to use the formula:

Activity Variance = (Actual Activity - Budgeted Activity) x Budgeted Rate

In this case, the actual activity is 6,670 units and the budgeted activity is 6,700 units, resulting in a difference of 30 units. The budgeted rate for direct labor is $8 per unit.

Therefore, the activity variance for direct labor is:

Activity Variance = (6,670 - 6,700) x $8 = -$240

Since the activity variance is negative, it means that the actual direct labor cost was higher than the budgeted direct labor cost. To convert the activity variance to a positive number, we need to change the sign, resulting in $240 F (favorable).

Therefore, the closest option is C) $216 F (favorable). Note that this is not the exact answer, but it is the closest option.

Activity Variance = (Actual Activity - Budgeted Activity) x Budgeted Rate

In this case, the actual activity is 6,670 units and the budgeted activity is 6,700 units, resulting in a difference of 30 units. The budgeted rate for direct labor is $8 per unit.

Therefore, the activity variance for direct labor is:

Activity Variance = (6,670 - 6,700) x $8 = -$240

Since the activity variance is negative, it means that the actual direct labor cost was higher than the budgeted direct labor cost. To convert the activity variance to a positive number, we need to change the sign, resulting in $240 F (favorable).

Therefore, the closest option is C) $216 F (favorable). Note that this is not the exact answer, but it is the closest option.

Learning Objectives

- Achieve fluency in the process of determining and deciphering variances in activity for different expenditure categories.

- Acknowledge the effects of differing activity levels on fixed and variable expenses.