Asked by Tylour Smith on Jul 18, 2024

Verified

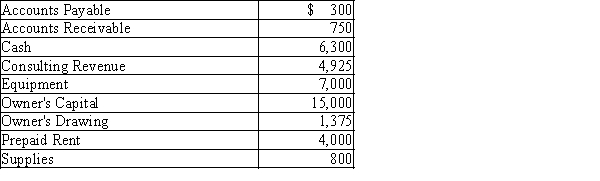

Jordon James started JJJ Consulting on January 1. The following are the account balances at the end of the first month of business, before adjusting entries were recorded:  Adjustment data:Supplies on hand at the end of the month, $200Unbilled consulting revenue, $700Rent expense for the month, $1,000Depreciation on equipment, $90

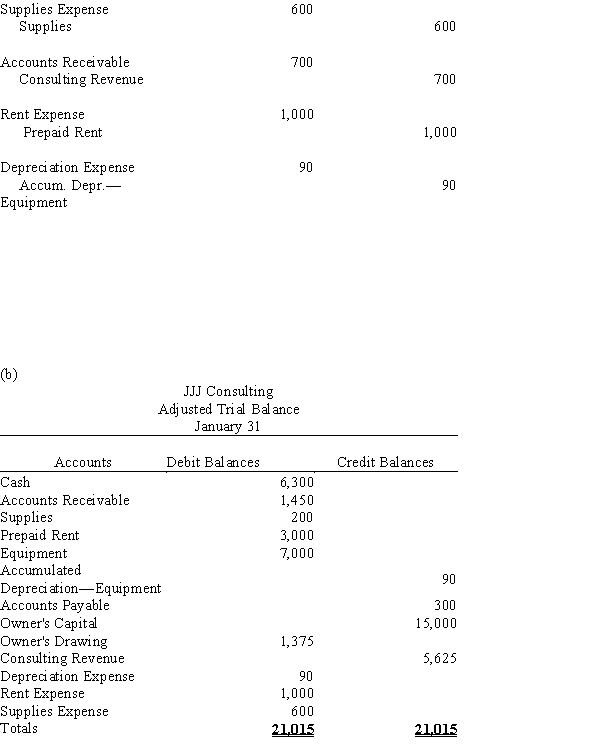

Adjustment data:Supplies on hand at the end of the month, $200Unbilled consulting revenue, $700Rent expense for the month, $1,000Depreciation on equipment, $90

(a) Prepare the required adjusting entries, adding accounts as needed.

(b) Prepare an adjusted trial balance for JJJ Consulting as of January 31.

Adjustment Data

Information used to make changes to accounts for the purposes of accurate financial reporting, such as accruals or deferrals.

Unbilled Consulting Revenue

Revenue earned from consulting services that have been delivered but not yet invoiced to the client.

Depreciation

The allocation of the cost of a tangible asset over its useful life, reflecting its loss of value over time.

- Record adjusting entries in the journal for unearned revenues, prepaid expenses, accrued expenses, and depreciation.

- Organize and become conversant with the revised trial balance.

Verified Answer

Learning Objectives

- Record adjusting entries in the journal for unearned revenues, prepaid expenses, accrued expenses, and depreciation.

- Organize and become conversant with the revised trial balance.

Related questions

On December 31, a Business Estimates Depreciation on Equipment Used ...

For Each of the Following Errors, Considered Individually, Indicate Whether ...

On January 2, Safe Motorcycling Monthly Received a Check for ...

Prepare the Required Entries for the Following Transactions ...

The Supplies Account Balance on December 31, $4,750; Supplies on ...