Asked by Rafael Leyva on May 03, 2024

Verified

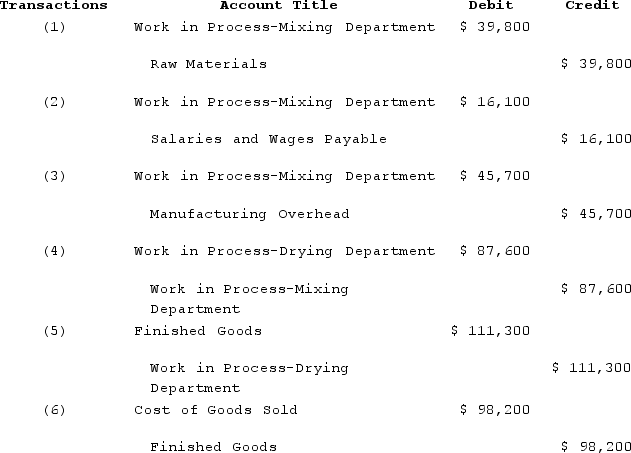

Bayas Corporation uses process costing. A number of transactions that occurred in June are listed below.(1) Raw materials that cost $39,800 are withdrawn from the storeroom for use in the Mixing Department. All of these raw materials are classified as direct materials.(2) Direct labor costs of $16,100 are incurred, but not yet paid, in the Mixing Department.(3) Manufacturing overhead of $45,700 is applied in the Mixing Department using the department's predetermined overhead rate.(4) Units with a carrying cost of $87,600 finish processing in the Mixing Department and are transferred to the Drying Department for further processing.(5) Units with a carrying cost of $111,300 finish processing in the Drying Department, the final step in the production process, and are transferred to the finished goods warehouse.(6) Finished goods with a carrying cost of $98,200 are sold.Required:Prepare journal entries for each of the transactions listed above.

Process Costing

An accounting methodology used for homogenous products, where costs are assigned to mass-produced items over a set period.

Predetermined Overhead Rate

A rate used to allocate overhead costs to products or services, based on a planned amount of cost and activity.

Direct Materials

Raw materials that can be directly traced to the manufacturing process of a product and are considered a variable cost.

- Prepare journal entries for various transactions in a process costing system.

Verified Answer

Learning Objectives

- Prepare journal entries for various transactions in a process costing system.

Related questions

When Materials Are Purchased in a Process Costing System, a ...

Aztec Inc'S Standard Labor Cost of Producing One Unit of ...

Jet Industries Purchased 6000 Units of Raw Material on Account ...

During December, Moulding Corporation Incurred $76,000 of Actual Manufacturing Overhead ...

Prahm Incorporated Has Provided the Following Data for August ...