Asked by Nicole Guerrero on Jun 13, 2024

Verified

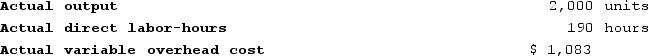

Balladares Incorporated has a standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours. The standard for variable manufacturing overhead is 0.10 hours at $6.30 per hour. The company has reported the following actual results for the product for May:

Required:

Required:

a. Compute the variable overhead rate variance for May.

b. Compute the variable overhead efficiency variance for May.

Variable Overhead Rate Variance

The difference between the actual variable overhead costs incurred and the standard variable overhead expected for the actual production achieved.

Variable Overhead Efficiency Variance

A measure used in cost accounting to evaluate the efficiency of variable production costs, comparing the actual hours worked to the standard hours expected.

- Apply variable overhead charges to products and evaluate the variable overhead deviations.

Verified Answer

= $1,083 − (190 hours × $6.30 per hour)

= $1,083 − ($1,197)

= $114 Favorable

b. Standard hours = 2,000 units × 0.10 hours per unit = 200 hours

Variable overhead efficiency variance = (Actual hours × Standard rate) − (Standard hours × Standard rate)

= (Actual hours − Standard hours) × Standard rate

= (190 hours − 200 hours) × $6.30 per hour

= (−10 hours) × $6.30 per hour

= $63 Favorable

Learning Objectives

- Apply variable overhead charges to products and evaluate the variable overhead deviations.

Related questions

Doby Corporation Makes a Product with the Following Standard Costs ...

Klacic Corporation Makes a Product with the Following Standard Costs ...

Kropf Incorporated Has Provided the Following Data Concerning One of ...

Heye Incorporated Has Provided the Following Data Concerning One of ...

Creger Corporation, Which Makes Landing Gears, Has Provided the Following ...