Asked by Jaqueline Martinez on Jul 03, 2024

Verified

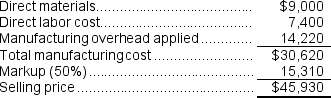

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments.Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices.The calculated selling price for Job M is closest to:

A) $15,310

B) $47,767

C) $30,620

D) $45,930

Departmental Predetermined Overhead Rates

The overhead rates set for specific departments within a company, based on estimated costs and activity levels.

Manufacturing Cost

The total expense incurred in the process of producing a product, including raw materials, labor, and overhead.

Selling Price

The price at which a product or service is offered to consumers.

- Determine the sales price of goods by incorporating a markup into the cost per unit of products.

- Distinguish between the use of plantwide and departmental predetermined overhead rates.

Verified Answer

BS

Barrington SaintJul 08, 2024

Final Answer :

D

Explanation :

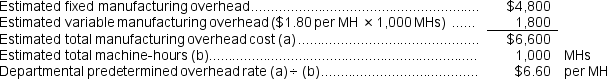

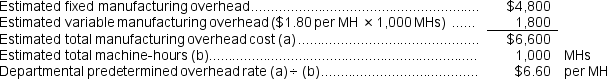

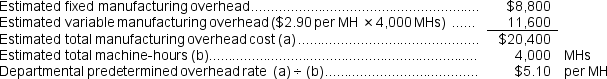

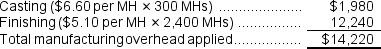

Casting Department predetermined overhead rate:  Finishing Department predetermined overhead rate:

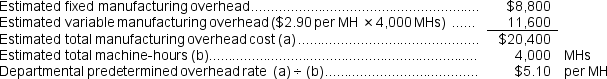

Finishing Department predetermined overhead rate:  Manufacturing overhead applied to Job M:

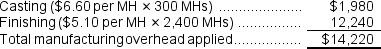

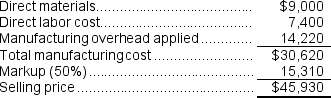

Manufacturing overhead applied to Job M:  The selling price for Job M would be calculated as follows:

The selling price for Job M would be calculated as follows:  Reference: CH02-Ref28

Reference: CH02-Ref28

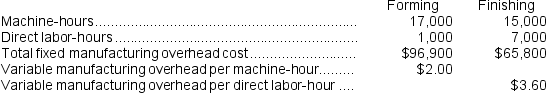

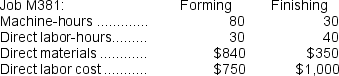

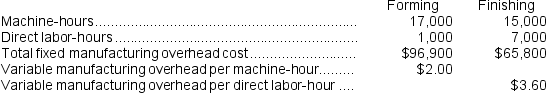

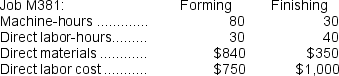

Hickingbottom Corporation has two production departments, Forming and Finishing.The company uses a job-order costing system and computes a predetermined overhead rate in each production department.The Forming Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours.At the beginning of the current year, the company had made the following estimates: During the current month the company started and finished Job M381.The following data were recorded for this job:

During the current month the company started and finished Job M381.The following data were recorded for this job:

Finishing Department predetermined overhead rate:

Finishing Department predetermined overhead rate:  Manufacturing overhead applied to Job M:

Manufacturing overhead applied to Job M:  The selling price for Job M would be calculated as follows:

The selling price for Job M would be calculated as follows:  Reference: CH02-Ref28

Reference: CH02-Ref28Hickingbottom Corporation has two production departments, Forming and Finishing.The company uses a job-order costing system and computes a predetermined overhead rate in each production department.The Forming Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours.At the beginning of the current year, the company had made the following estimates:

During the current month the company started and finished Job M381.The following data were recorded for this job:

During the current month the company started and finished Job M381.The following data were recorded for this job:

Learning Objectives

- Determine the sales price of goods by incorporating a markup into the cost per unit of products.

- Distinguish between the use of plantwide and departmental predetermined overhead rates.

Related questions

If the Company Marks Up Its Unit Product Costs by ...

Carcana Corporation Has Two Manufacturing Departments--Machining and Finishing ...

Worker's World Bought 250 Pairs of Rubber Boots at $15 ...

A Florist Buys Potted Poinsettias from a Nursery at $15 ...

Digital Devices Sets Its Retail Prices on Computers, Monitors, and ...