Asked by Yenifer Medina on Jul 03, 2024

Verified

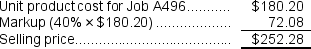

If the company marks up its unit product costs by 40% then the selling price for a unit in Job A496 is closest to:

A) $186.20

B) $272.28

C) $72.08

D) $252.28

Unit Product Costs

The total cost associated with producing one unit of product, including direct materials, direct labor, and allocated overhead costs.

Markup

The amount added to the cost of goods to cover overhead and profit, determining the selling price.

Selling Price

The amount of money a customer pays to buy a product or service.

- Calculate the selling price for products by applying a markup to unit product costs.

Verified Answer

JM

Johana Medrano-RoweJul 09, 2024

Final Answer :

D

Explanation :

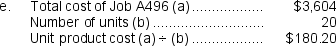

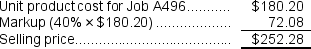

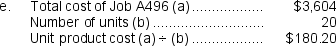

We need to calculate the selling price for a unit in Job A496. Let the unit product cost be x.

After marking up by 40%, the selling price will be 1.4x.

From the information given in the question, we do not know what the actual unit product cost is, so we cannot directly calculate the selling price.

Therefore, we need to use the answer choices to back-calculate the unit product cost using the marked-up selling price:

Option A: Selling price = $186.20 --> x = $133.00 (approximately)

Option B: Selling price = $272.28 --> x = $194.49 (approximately)

Option C: Selling price = $72.08 --> x = $51.49 (approximately)

Option D: Selling price = $252.28 --> x = $180.20 (approximately)

Out of these options, only Option D has a reasonable unit product cost that is consistent with the question (i.e. not too high or too low). Therefore, the best choice is D.

After marking up by 40%, the selling price will be 1.4x.

From the information given in the question, we do not know what the actual unit product cost is, so we cannot directly calculate the selling price.

Therefore, we need to use the answer choices to back-calculate the unit product cost using the marked-up selling price:

Option A: Selling price = $186.20 --> x = $133.00 (approximately)

Option B: Selling price = $272.28 --> x = $194.49 (approximately)

Option C: Selling price = $72.08 --> x = $51.49 (approximately)

Option D: Selling price = $252.28 --> x = $180.20 (approximately)

Out of these options, only Option D has a reasonable unit product cost that is consistent with the question (i.e. not too high or too low). Therefore, the best choice is D.

Explanation :

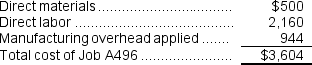

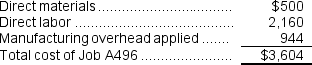

Estimated total manufacturing overhead cost = Estimated total fixed manufacturing overhead cost + (Estimated variable overhead cost per unit of the allocation base × Estimated total amount of the allocation base)= $237,000 + ($3.90 per machine-hour × 30,000 machine-hours)= $237,000 + $117,000 = $354,000

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $354,000 ÷ 30,000 machine-hours = $11.80 per machine-hour

Overhead applied to a particular job = Predetermined overhead rate x Amount of the allocation base incurred by the job = $11.80 per machine-hour × 80 machine-hours = $944

Reference: CH02-Ref23

Reference: CH02-Ref23

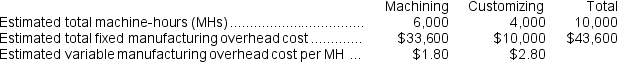

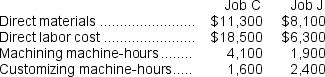

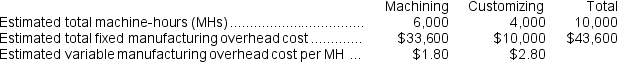

Halbur Corporation has two manufacturing departments--Machining and Customizing.The company used the following data at the beginning of the year to calculate predetermined overhead rates: During the most recent month, the company started and completed two jobs--Job C and Job J.There were no beginning inventories.Data concerning those two jobs follow:

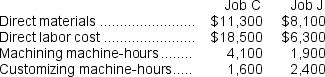

During the most recent month, the company started and completed two jobs--Job C and Job J.There were no beginning inventories.Data concerning those two jobs follow:

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $354,000 ÷ 30,000 machine-hours = $11.80 per machine-hour

Overhead applied to a particular job = Predetermined overhead rate x Amount of the allocation base incurred by the job = $11.80 per machine-hour × 80 machine-hours = $944

Reference: CH02-Ref23

Reference: CH02-Ref23Halbur Corporation has two manufacturing departments--Machining and Customizing.The company used the following data at the beginning of the year to calculate predetermined overhead rates:

During the most recent month, the company started and completed two jobs--Job C and Job J.There were no beginning inventories.Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job C and Job J.There were no beginning inventories.Data concerning those two jobs follow:

Learning Objectives

- Calculate the selling price for products by applying a markup to unit product costs.

Related questions

Assume That the Company Uses Departmental Predetermined Overhead Rates with ...

Digital Devices Sets Its Retail Prices on Computers, Monitors, and ...

Worker's World Bought 250 Pairs of Rubber Boots at $15 ...

Omega Restaurant Buys Shiraz Wine at $16 ...

The Shoe Shop's Normal Rate of Mark-Up on Selling Price ...