Asked by YikOn Cheung on Jul 15, 2024

Verified

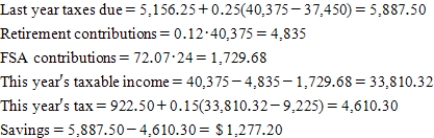

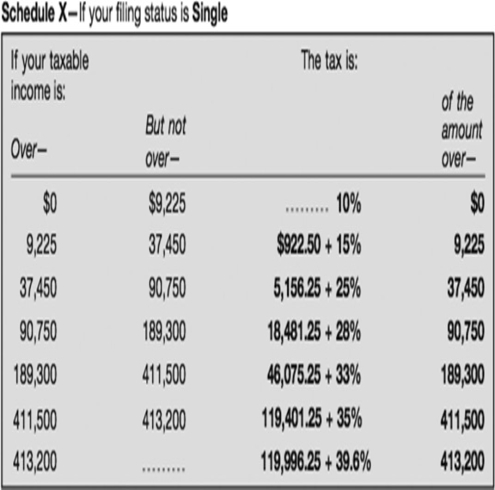

Asa is single and had taxable income last year of $40,375.At the beginning of the new year,he decided to save 12% of last year's taxable income in a tax -deferred savings plan.His company also started a flexible spending account for medical contributions.Asa's medical insurance is 72.07 per semi-monthly pay.How much can Asa expect to save in taxes this year due to these changes?

Tax-Deferred Savings

Investment accounts, like IRAs and 401(k)s, where contributions and earnings are tax-exempt until withdrawal, typically at retirement.

Flexible Spending Account

A special account you put money into that you use to pay for certain out-of-pocket health care costs, using pre-tax dollars, thus reducing taxable income.

Medical Insurance

A type of insurance coverage that pays for an insured individual's healthcare expenses.

- Estimate the impact of tax-deferred savings and flexible spending accounts on tax savings.

Verified Answer

MB

Learning Objectives

- Estimate the impact of tax-deferred savings and flexible spending accounts on tax savings.