Asked by Kayelyn Rooney on May 21, 2024

Verified

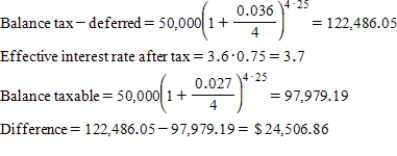

Jackson inherited $50,000 at the age of 42 and had a decision to make.He could deposit the money in a tax -deferred account that pays 3.375% compounded quarterly or he could deposit the money in a taxable account with the same interest rate and compounding period.Jackson's current tax bracket is 25%,which means he will have to pay taxes on the interest earned each year in the taxable account.How much money could Jackson have saved after 25 years if his decision was to deposit the inheritance into the taxable account?

Tax-Deferred Account

A savings account or investment option where taxes on the principal and/or earnings are delayed until the investor withdraws the funds.

Taxable Account

An investment account in which the earnings are subject to income tax.

Compounded Quarterly

The process of adding interest to the principal sum of a loan or deposit, calculated every three months.

- Compare the financial outcomes of tax-deferred versus taxable investment accounts.

Verified Answer

MT

Learning Objectives

- Compare the financial outcomes of tax-deferred versus taxable investment accounts.

Related questions

When Congress Changes the Tax Laws or Rates, a Corporation's ...

Temporary Differences That Will Cause Taxable Income to Be Higher ...

A Revenue Item That Causes Book Income to Be More ...

Temporary Differences This Year That Will Cause Taxable Income to ...

The Disclosures with Respect to Deferred Income Taxes Can Be ...