Asked by stephanie santacruz on Jul 21, 2024

Verified

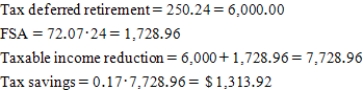

Angela's effective federal tax rate is 17%.Last year,she was able to reduce taxable income by contributing $250.00 per semi-monthly paycheck to her tax -deferred retirement account and $72.07 per semi-monthly paycheck to her flexible spending account.How much did she reduce her federal taxes by if her gross semi-monthly pay is $2,819.96?

Effective Federal Tax Rate

The average rate at which an individual or a corporation is taxed by the federal government, calculated by dividing the total tax paid by taxable income.

Tax-Deferred Retirement

Investment accounts, like 401(k)s or IRAs, that allow earnings to grow tax-free until funds are withdrawn, usually during retirement.

Flexible Spending Account

A type of savings account, usually for healthcare or dependent care expenses, that offers tax advantages by using pre-tax dollars.

- Evaluate the effect of tax-deferred retirement contributions and flexible spending accounts on federal taxes.

Verified Answer

Learning Objectives

- Evaluate the effect of tax-deferred retirement contributions and flexible spending accounts on federal taxes.

Related questions

Asa Is Single and Had Taxable Income Last Year of ...

Which of the Following Statements Regarding Individual Retirement Accounts (IRA)is ...

When Congress Changes the Tax Laws or Rates, a Corporation's ...

Jackson Inherited $50,000 at the Age of 42 and Had ...

Which of the Following Statements Is Correct ...