Asked by percy jackson on May 25, 2024

Verified

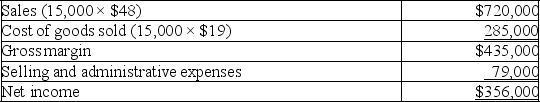

Anchovy,Inc.,a producer of frozen pizzas,began operations this year.During this year,the company produced 16,000 cases of pizza and sold 15,000.At year-end,the company reported the following income statement using absorption costing:

Production costs per case total $19,which consists of $15.50 in variable production costs and $3.50 in fixed production costs (based on the 16,000 units produced).Eight percent of total selling and administrative expenses are variable.Compute net income under variable costing.

Production costs per case total $19,which consists of $15.50 in variable production costs and $3.50 in fixed production costs (based on the 16,000 units produced).Eight percent of total selling and administrative expenses are variable.Compute net income under variable costing.

Absorption Costing

A methodology for product costing that comprehensively adds up the costs of direct materials, direct labor, and both fixed and variable manufacturing overheads.

Variable Costing

An accounting method that only includes variable costs (costs that change with production levels) in the cost of goods sold and treatment of fixed costs.

Production Costs

The total expenses incurred in the manufacture of products, including costs related to labor, raw materials, and overhead.

- Determine the net earnings employing variable as well as absorption costing techniques.

- Understand how fixed overhead costs are treated within the two costing approaches.

Verified Answer

YR

Yakelin Rodriguez-AgueroMay 28, 2024

Final Answer :

Income under absorption costing = Income under variable costing + FOH in Ending inventory - FOH in Beginning inventory

$356,000 = Income under variable costing ($3.50 x 0 units)+ ($3.50 × 1,000 units)

$352,500 = Income under variable costing

$356,000 = Income under variable costing ($3.50 x 0 units)+ ($3.50 × 1,000 units)

$352,500 = Income under variable costing

Learning Objectives

- Determine the net earnings employing variable as well as absorption costing techniques.

- Understand how fixed overhead costs are treated within the two costing approaches.