Asked by Dionne Duncan on Jun 22, 2024

Verified

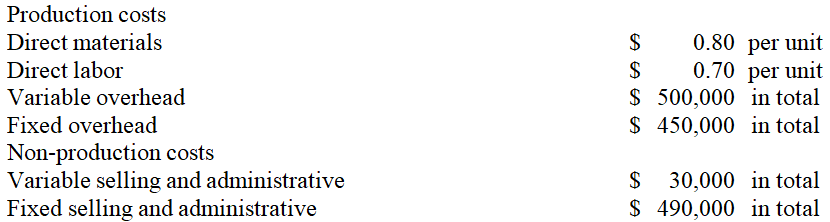

Vision Tester,Inc.,a manufacturer of optical glass,began operations on February 1 of the current year.During this time,the company produced 900,000 units and sold 800,000 units at a sales price of $12 per unit.Cost information for this year is shown in the following table:  Given this information,which of the following is true?

Given this information,which of the following is true?

A) Net income under variable costing will exceed net income under absorption costing by $50,000.

B) Net income under absorption costing will exceed net income under variable costing by $50,000.

C) Net income will be the same under both absorption and variable costing.

D) Net income under variable costing will exceed net income under absorption costing by $60,000.

E) Net income under absorption costing will exceed net income under variable costing by $60,000.

Net Income

The total profit of a company after all expenses and taxes have been subtracted from total revenue.

Variable Costing

An accounting method that only considers variable costs (costs that change with production levels) in determining product cost, excluding fixed costs.

- Differentiate between absorption and variable costing.

- Ascertain net income through the use of variable and absorption costing approaches.

Verified Answer

TD

Thamar DelvaJun 25, 2024

Final Answer :

B

Explanation :

Under absorption costing, both fixed and variable costs are included in the cost of goods sold. However, under variable costing, only variable costs are included in the cost of goods sold. Since the company produced more units than it sold, under absorption costing, some of the fixed costs will be included in the cost of goods sold and deducted from revenue, reducing net income. Under variable costing, those fixed costs will be treated as period costs and deducted from gross profit. Therefore, net income under absorption costing will exceed net income under variable costing by the amount of fixed costs included in the cost of goods sold. The fixed costs per unit are $3, calculated as follows: ($3,965,000 ÷ 900,000 units). Therefore, the difference in net income is $50,000 calculated as follows: ($800,000 units x $12.00 sales price) - [($3.40 variable cost per unit + $3.965 fixed cost per unit) x 800,000 units] = $280,000 - $446,000 = $(166,000).

Hence, option B is correct.

Hence, option B is correct.

Learning Objectives

- Differentiate between absorption and variable costing.

- Ascertain net income through the use of variable and absorption costing approaches.