Asked by Joshua Gagen on Apr 24, 2024

Verified

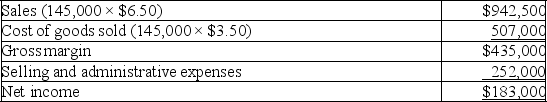

Chilly Chips,Inc.,a producer of ice cream,began operations this year.During this year,the company produced 160,000 cartons of ice cream and sold 145,000.At year-end,the company reported the following income statement using absorption costing:

Production costs per carton total $3.50,which consists of $2.30 in variable production costs and $1.20 in fixed production costs (based on the 160,000 units produced).Sixty percent of total selling and administrative expenses are variable.Compute net income under variable costing.

Production costs per carton total $3.50,which consists of $2.30 in variable production costs and $1.20 in fixed production costs (based on the 160,000 units produced).Sixty percent of total selling and administrative expenses are variable.Compute net income under variable costing.

Production Costs

Expenses directly related to the creation of goods and services, including materials, labor, and overhead costs.

Absorption Costing

In this accounting method, total costs of manufacturing, from direct materials and labor to both fixed and variable overheads, are completely absorbed into the product’s final cost.

Variable Costing

Variable costing is a cost accounting method that includes only variable production costs—direct materials, direct labor, and variable manufacturing overhead—in product cost calculations, excluding fixed overhead costs.

- Estimate the net profit through the usage of variable and absorption costing methodologies.

- Acknowledge how both costing methods address fixed overhead costs.

Verified Answer

JM

Jolene MaciasMay 02, 2024

Final Answer :

Income under absorption costing = Income under variable costing + FOH in Ending inventory - FOH in Beginning inventory

$183,000 = Income under variable costing + ($1.20 × 15,000 units)- ($1.20 x 0 units)

$165,000 = Income under variable costing

$183,000 = Income under variable costing + ($1.20 × 15,000 units)- ($1.20 x 0 units)

$165,000 = Income under variable costing

Learning Objectives

- Estimate the net profit through the usage of variable and absorption costing methodologies.

- Acknowledge how both costing methods address fixed overhead costs.