Asked by Matias Morales on Apr 25, 2024

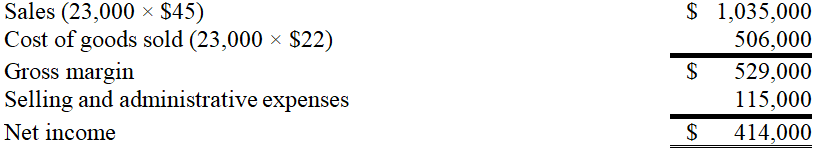

Aces,Inc.,a manufacturer of tennis rackets,began operations this year.The company produced 6,000 rackets and sold 4,900.At year-end,the company reported the following income statement using absorption costing.  Production costs per tennis racket total $38,which consists of $25 in variable production costs and $13 in fixed production costs (based on the 6,000 units produced) .Ten percent of total selling and administrative expenses are variable.Compute net income under variable costing.

Production costs per tennis racket total $38,which consists of $25 in variable production costs and $13 in fixed production costs (based on the 6,000 units produced) .Ten percent of total selling and administrative expenses are variable.Compute net income under variable costing.

A) $194,100

B) $165,500

C) $311,000

D) $240,500

E) $233,000

Variable Costing

An approach to costing that accounts for only variable production expenses, including direct materials, direct labor, and variable manufacturing overhead, in the calculation of product costs.

Absorption Costing

A costing approach that consolidates every expense related to manufacturing - direct materials, direct labor, and both variable and fixed overheads - into the product’s price.

Variable Production Costs

Costs that change in proportion to the level of production activity, such as materials and labor directly involved in manufacturing.

- Compute the net income by utilizing variable and absorption costing strategies.

- Assess the consequences of changes in production and sales quantities on net income.

Learning Objectives

- Compute the net income by utilizing variable and absorption costing strategies.

- Assess the consequences of changes in production and sales quantities on net income.