Asked by Rainn Cline on Jun 11, 2024

Verified

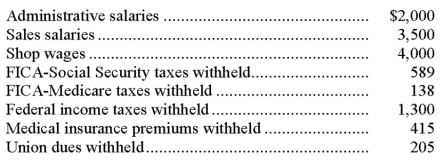

A company's payroll information for the month of May follows:

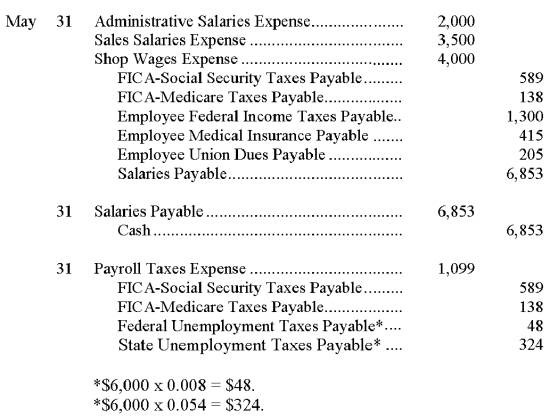

On May 31 the company issued Check No. 335 payable to the Payroll Bank Account to pay for the May payroll. It issued payroll checks to the employees after depositing the check.

(1) Prepare the journal entry to record (accrue) the employer's payroll for May. (2) Prepare the journal entry to record payment of the May payroll. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. The wages and salaries subject to these taxes were $6,000. (3) Prepare the journal entry to record the employer's payroll taxes.

Unemployment Tax

Taxes paid by employers to fund unemployment insurance programs, offering temporary financial assistance to unemployed workers.

- Gain knowledge in preparing payroll and related journal entries, including computing employee earnings and deductions.

- Learn how to calculate employer payroll taxes and other related employer expenses.

Verified Answer

FL

Learning Objectives

- Gain knowledge in preparing payroll and related journal entries, including computing employee earnings and deductions.

- Learn how to calculate employer payroll taxes and other related employer expenses.