Asked by Taylor Ingram on Jul 09, 2024

Verified

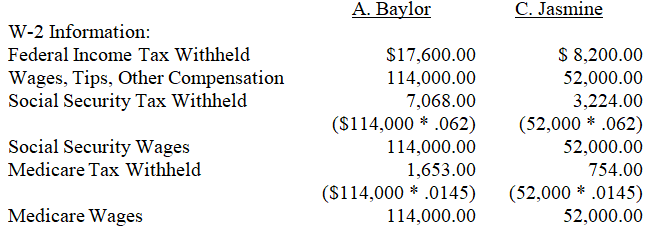

A company's employer payroll tax rates are 0.6% for federal unemployment taxes,5.4% for state unemployment taxes,6.2% for FICA social security taxes on earnings up to $128,400,and 1.45% for FICA Medicare taxes on all earnings.Compute the W-2 Wage and Tax Statement information required below for the following employees:

Employer Payroll Tax Rates

The percentage rates at which employers are required to tax their employees' wages for federal and state payroll taxes.

FICA Social Security Taxes

Taxes paid by both employers and employees to fund the Social Security program, determined as a percentage of payroll.

FICA Medicare Taxes

These are taxes collected from both employers and employees in the United States to fund the Medicare program, which provides healthcare benefits for qualified individuals.

- Become proficient in determining employer payroll taxes from diverse earnings and tax rates.

- Understand the process of recording employee earnings information, including W-2 Wage and Tax Statement information.

- Build proficiency in creating general journal entries for payroll activities, covering both accruals and payments.

Verified Answer

VK

Learning Objectives

- Become proficient in determining employer payroll taxes from diverse earnings and tax rates.

- Understand the process of recording employee earnings information, including W-2 Wage and Tax Statement information.

- Build proficiency in creating general journal entries for payroll activities, covering both accruals and payments.