Asked by Lupita Sanchez on May 16, 2024

Verified

A company purchased a machine on January 1 of the current year for $750,000.Calculate the annual depreciation expense for each year of the machine's life (estimated at 5 years or 20,000 hours,with a salvage value of $75,000)using each of the below-mentioned methods.During the machine's 5-year life its hourly usage was: 3,000; 4,000; 5,000; 5,000; and 3,000 hours.

Units-Of-Production

Units-of-production is a method of depreciation that allocates the cost of an asset over its useful life based on the number of units it produces, reflecting wear and use more accurately.

Depreciation Expense

The systematic allocation of the cost of a tangible asset over its useful life, reflecting the decrease in value due to use and time.

Salvage Value

The predicted sale value of an asset at the end of its operational life.

- Ascertain and note the depreciation expenses of fixed assets by several methods.

- Understand and apply the concept of depletion for resource-based assets.

Verified Answer

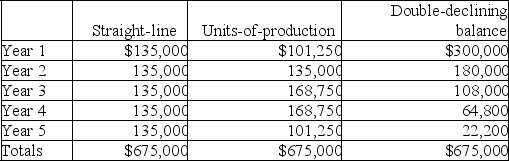

Straight-line: ($750,000 - $75,0000)/ 5 years = $135,000 per year

Straight-line: ($750,000 - $75,0000)/ 5 years = $135,000 per yearUnits of production: ($750,000 - $75,000)/ 20,000 hours = $33.75 per hour

Year 1 hours 3,000 * $33.75 = $101,250

Year 2 hours 4,000 * $33.75 = $135,000

Year 3 hours 5,000 * $33.75 = $168,750

Year 4 hours 5,000 * $33.75 = $168,750

Year 5 hours 3,000 * $33.75 = $101,250

Double-declining:

Year 1 $750,000 * 40% = $300,000

Year 2 ($750,000 - $300,000)* 40% = $180,000

Year 3 ($750,0000 - $480,000)* 40% = $108,000

Year 4 ($750,000 - $588,000)* 40% = $64,800

Year 5 ($750,000 - $652,800)* 40% = $38,880 but limited to $22,200 by salvage value

Learning Objectives

- Ascertain and note the depreciation expenses of fixed assets by several methods.

- Understand and apply the concept of depletion for resource-based assets.

Related questions

A Company Purchased a Cooling System on January 2 for ...

A Company Purchased Mining Property for $1,560,000 ...

On January 1,a Machine Costing $260,000 with a 6-Year Life ...

On January 1,a Company Purchased Machinery for $75,000 That Had ...

The Federal Income Tax Rules for Depreciating Assets Are Known ...