Asked by Mary Tillman Davis on Apr 24, 2024

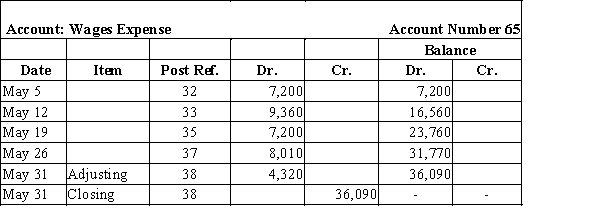

Zeta Company has 12 workers who each earn $15 per hour and generally work a 40-hour workweek, although at times overtime work is required, for which workers are paid 1.5 times their regular hourly wage. Zeta pays wages in cash on Friday of each week for work performed that week. Zeta's Wages Expense ledger account for May is shown below.  During the period May 27 through June 2, Zeta's workers worked a regular 40-hour week.

During the period May 27 through June 2, Zeta's workers worked a regular 40-hour week.

1. If Zeta Company uses reversing entries, journalize the entry made when payroll is paid in cash on June 2, assuming that appropriate reversing entry(ies) have been made at the beginning of June. You may omit posting references.

2. If Zeta Company does not use reversing entries, journalize the entry made when payroll is paid in cash on June 2. You may omit posting references.

Reversing Entries

Entries recorded at the start of a new accounting cycle to negate or annul the effects of adjustments entered at the conclusion of the prior cycle.

Wages Expense

This is the total amount of money paid to employees for work performed during a specific period.

Payroll

The total amount of money paid by a business to its employees over a set period, including wages, salaries, bonuses, and deductions.

- Comprehend and execute the process of journalizing reversing entries and their influence on financial statements.

- Document and comprehend the importance of making adjustments in entries while preparing financial statements.

Learning Objectives

- Comprehend and execute the process of journalizing reversing entries and their influence on financial statements.

- Document and comprehend the importance of making adjustments in entries while preparing financial statements.

Related questions

Kirk Enterprises Offers Rug Cleaning Services to Business Clients ...

Journalize the Reversing Entry on January 1 of the Current ...

Kirk Enterprises Offers Rug Cleaning Services to Business Clients ...

Describe the Types of Entries Required in Later Periods That ...

Describe the Adjusting Entries,including the Accounts Used,for 1)prepaid Expenses,2)depreciation and ...