Asked by Roberta Carubia on May 06, 2024

Verified

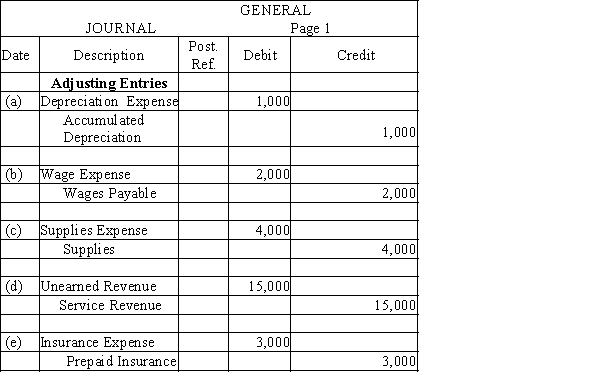

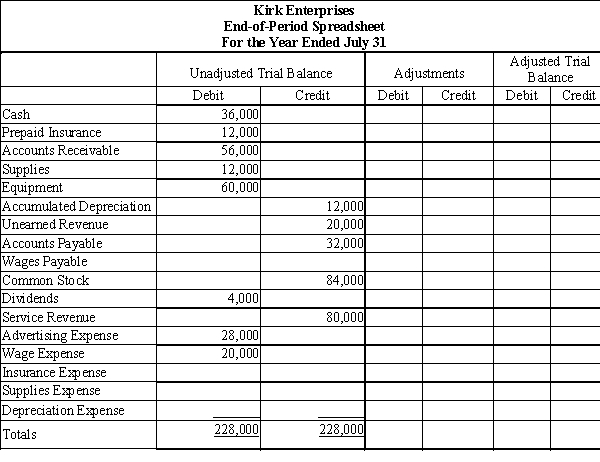

Kirk Enterprises offers rug cleaning services to business clients. Below is the adjustments data for the year ended July 31. Using this information along with the spreadsheet below, record the adjusting entries in proper general journal form.Adjustments:

(a) Depreciation expense, $1,000.(b) Wages accrued, but not paid, $2,000.(c) Supplies on hand, $8,000.(d) Of the unearned revenue, 75% has been earned.(e) Unexpired insurance at July 31, $9,000.

Depreciation Expense

Distributing the expense of a physical asset across its lifespan, representing the reduction in its worth as time progresses.

Unearned Revenue

Money received by a company for products or services that have not yet been delivered or completed, considered a liability until the revenue is earned.

Adjusting Entries

Journal entries made in accounting to update the records for expenses and revenues that have accrued but are not yet recorded.

- Record and understand the significance of adjusting entries in the preparation of financial statements.

Verified Answer

Learning Objectives

- Record and understand the significance of adjusting entries in the preparation of financial statements.

Related questions

Zeta Company Has 12 Workers Who Each Earn $15 Per ...

Kirk Enterprises Offers Rug Cleaning Services to Business Clients ...

Describe the Types of Entries Required in Later Periods That ...

Describe the Adjusting Entries,including the Accounts Used,for 1)prepaid Expenses,2)depreciation and ...

Adjusting Entries Are Made After the Preparation of Financial Statements