Asked by Erica Cluff on May 09, 2024

Verified

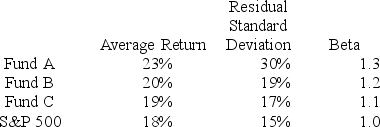

You want to evaluate three mutual funds using the Sharpe measure for performance evaluation. The risk-free return during the sample period is 5%. The average returns, standard deviations, and betas for the three funds are given below, as are the data for the S&P 500 Index.

The investment with the highest Sharpe measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) the index.

E) Funds A and C (tied for highest) .

Sharpe Measure

A metric used to evaluate the risk-adjusted return of an investment portfolio.

Risk-Free Return

The guaranteed return on an investment with zero risk of financial loss, typically associated with government bonds.

Standard Deviation

Standard deviation is a statistical measure of the dispersion or variability of a set of data points, commonly used to quantify the risk associated with an investment's return.

- Absorb the essentials and calculations of risk-adjusted metrics, such as the Treynor measure, Sharpe measure, and Jensen's alpha.

Verified Answer

Learning Objectives

- Absorb the essentials and calculations of risk-adjusted metrics, such as the Treynor measure, Sharpe measure, and Jensen's alpha.

Related questions

Suppose Two Portfolios Have the Same Average Return and the ...

________ Developed a Popular Method for Risk-Adjusted Performance Evaluation of ...

Suppose Two Portfolios Have the Same Average Return and the ...

The Following Data Are Available Relating to the Performance of ...

________ Did Not Develop a Popular Method for Risk-Adjusted Performance ...