Asked by cemsid miroglu on May 27, 2024

Verified

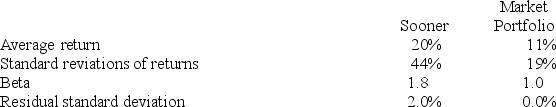

The following data are available relating to the performance of Sooner Stock Fund and the market portfolio:

The risk-free return during the sample period was 3%.

Calculate the Jensen measure of performance evaluation for Sooner Stock Fund.

A) 2.6%

B) 4.00%

C) 8.67%

D) 31.43%

E) 37.14%

Jensen Measure

A performance metric that calculates the excess return of a portfolio over the predicted return by the Capital Asset Pricing Model (CAPM).

Risk-Free Return

The return on an investment with no risk of financial loss, typically associated with government bonds.

- Master the theoretical underpinnings and quantitative analysis of risk-adjusted metrics like the Treynor measure, Sharpe measure, and Jensen's alpha.

Verified Answer

AS

Learning Objectives

- Master the theoretical underpinnings and quantitative analysis of risk-adjusted metrics like the Treynor measure, Sharpe measure, and Jensen's alpha.

Related questions

You Want to Evaluate Three Mutual Funds Using the Sharpe ...

________ Developed a Popular Method for Risk-Adjusted Performance Evaluation of ...

Suppose Two Portfolios Have the Same Average Return and the ...

Suppose Two Portfolios Have the Same Average Return and the ...

________ Did Not Develop a Popular Method for Risk-Adjusted Performance ...