Asked by Victoria Konko on Jun 10, 2024

Verified

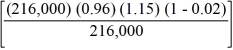

You pay $216,000 to the Capital Hedge Fund, which has a price of $18 per share at the beginning of the year. The fund deducted a front-end commission of 4%. The securities in the fund increased in value by 15% during the year. The fund's expense ratio is 2% and is deducted from year-end asset values. What is your rate of return on the fund if you sell your shares at the end of the year?

A) 5.35%

B) 7.23%

C) 8.19%

D) 10%

Front-end Commission

A fee paid when purchasing shares of a mutual fund, upfront, which reduces the amount invested from the start.

Expense Ratio

The annual fee that all funds and exchange-traded funds charge their shareholders, expressed as a percentage of the fund's total assets.

Rate of Return

The gain or loss on an investment over a specified time period, expressed as a percentage of the investment's cost.

- Examine the return frameworks of hedge funds along with the influence of fees on their returns.

Verified Answer

EA

Learning Objectives

- Examine the return frameworks of hedge funds along with the influence of fees on their returns.

- 1 = 8.19%

- 1 = 8.19%