Asked by Christina Ercolani on May 09, 2024

Verified

Which of the following statements is true for Year 1?

A) The amount of fixed manufacturing overhead released from inventories is $108,000

B) The amount of fixed manufacturing overhead deferred in inventories is $513,000

C) The amount of fixed manufacturing overhead released from inventories is $513,000

D) The amount of fixed manufacturing overhead deferred in inventories is $108,000

Fixed Manufacturing Overhead

These are production costs that do not change with the level of manufacturing activity, such as rent for factory premises.

Inventories

Assets held for sale in the ordinary course of business, or materials to be used or consumed in the production process.

Deferred

Postponed or delayed actions or transactions, often referring to income or expenses that will be recognized in a future accounting period.

- Understand how fixed manufacturing overhead is treated under variable and absorption costing.

Verified Answer

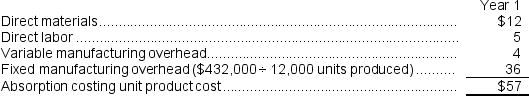

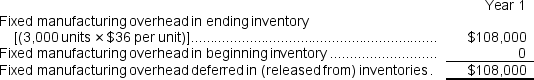

Fixed manufacturing overhead incurred = $621,000

Fixed manufacturing overhead applied = $729,000

This means that there is an over-applied amount of fixed manufacturing overhead, which needs to be deferred in inventories.

Over-applied amount = Applied amount - Incurred amount

Over-applied amount = $729,000 - $621,000

Over-applied amount = $108,000

Therefore, the correct statement is that the amount of fixed manufacturing overhead deferred in inventories is $108,000 (Option D).

Learning Objectives

- Understand how fixed manufacturing overhead is treated under variable and absorption costing.

Related questions

When Reconciling Variable Costing and Absorption Costing Net Operating Income ...

Under Variable Costing, Fixed Manufacturing Overhead Is Treated as a ...

Which of the Following Statements Is True ...

Arciba Incorporated Bases Its Manufacturing Overhead Budget on Budgeted Direct ...

The Manufacturing Overhead Budget at Franklyn Corporation Is Based on ...