Asked by Autumn Lewis on May 03, 2024

Verified

Which of the following statements is true?

A) The amount of fixed manufacturing overhead released from inventories is $248,000

B) The amount of fixed manufacturing overhead deferred in inventories is $248,000

C) The amount of fixed manufacturing overhead released from inventories is $30,000

D) The amount of fixed manufacturing overhead deferred in inventories is $30,000

Fixed Manufacturing Overhead

Costs that do not vary with the level of production or sales, such as salaries of managers, depreciation of manufacturing equipment, and rent of the factory building.

Deferred in Inventories

A situation where costs incurred in acquiring or producing inventory are postponed from being recognized as expenses until the goods are sold.

Released from Inventories

The process of moving goods from inventory to be used in production or to be sold, thereby reducing the inventory account.

- Gain an understanding of the absorption costing method and how it is calculated.

- Interpret the fixed manufacturing overheads in relation to inventories under absorption costing.

Verified Answer

ZK

Zybrea KnightMay 03, 2024

Final Answer :

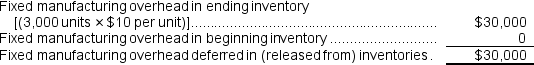

D

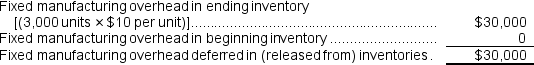

Explanation :

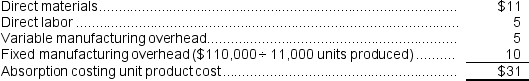

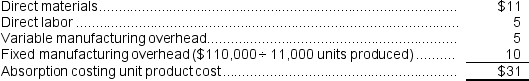

Absorption costing unit product costs:

Reference: CHO7-Ref19

Reference: CHO7-Ref19

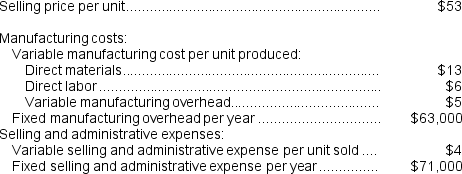

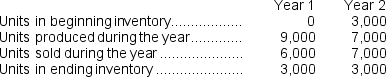

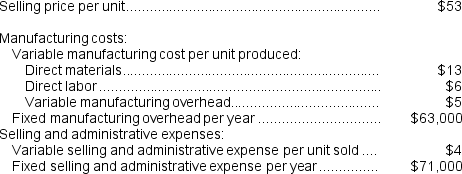

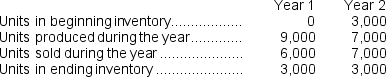

Bryans Corporation has provided the following data for its two most recent years of operation:

Reference: CHO7-Ref19

Reference: CHO7-Ref19Bryans Corporation has provided the following data for its two most recent years of operation:

Learning Objectives

- Gain an understanding of the absorption costing method and how it is calculated.

- Interpret the fixed manufacturing overheads in relation to inventories under absorption costing.