Asked by Cynthia Ocampo on Apr 26, 2024

Verified

The unit product cost under absorption costing is closest to:

A) $21.00

B) $31.00

C) $35.00

D) $10.00

Unit Product Cost

The total cost (including materials, labor, and overhead) divided by the number of units produced.

Absorption Costing

A financial recording technique that incorporates every manufacturing expense, such as direct materials, direct labor, and all overhead costs (variable and fixed), into the product's cost.

- Familiarize oneself with the notion of absorption costing and the techniques for its calculation.

- Determine and explain the cost per unit of product under variable and absorption costing techniques.

Verified Answer

IS

Itzel SantosApr 29, 2024

Final Answer :

B

Explanation :

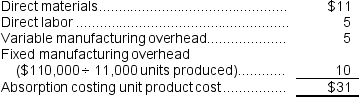

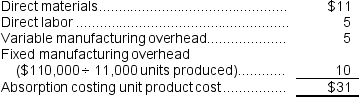

Under absorption costing, both variable and fixed manufacturing costs are included in the unit product cost. The calculation for unit product cost is:

Unit product cost = (total manufacturing costs for the period / total units produced)

Total manufacturing costs = direct materials + direct labor + variable manufacturing overhead + fixed manufacturing overhead

Total manufacturing costs for the period = $1,500,000 + $1,200,000 + ($10 per unit x 60,000 units) + $300,000 = $3,300,000

Unit product cost = ($3,300,000 / 106,000 units) = $31.13 (rounded to nearest cent)

Therefore, the closest option is B) $31.00.

Unit product cost = (total manufacturing costs for the period / total units produced)

Total manufacturing costs = direct materials + direct labor + variable manufacturing overhead + fixed manufacturing overhead

Total manufacturing costs for the period = $1,500,000 + $1,200,000 + ($10 per unit x 60,000 units) + $300,000 = $3,300,000

Unit product cost = ($3,300,000 / 106,000 units) = $31.13 (rounded to nearest cent)

Therefore, the closest option is B) $31.00.

Explanation :

Absorption costing unit product costs:

Learning Objectives

- Familiarize oneself with the notion of absorption costing and the techniques for its calculation.

- Determine and explain the cost per unit of product under variable and absorption costing techniques.