Asked by Maegan Neuman on May 05, 2024

Verified

When can IRR and NPV give different results? Explain how this can happen.

IRR

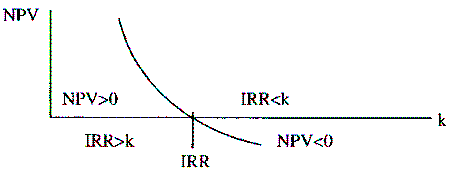

Internal Rate of Return (IRR) is a financial metric used to evaluate the profitability of investments, indicating the annualized rate of return that sets the net present value of all cash flows (both positive and negative) from a particular project equal to zero.

NPV

Net Present Value; a method used to evaluate the profitability of an investment by calculating the difference between the present value of cash inflows and outflows.

- Familiarize oneself with the idea of Net Present Value (NPV) and its role in the analysis of projects.

- Understand the basic principles of the Internal Rate of Return (IRR) and Modified Internal Rate of Return (MIRR), along with the distinctions between them.

- Recognize the significance of reinvestment assumptions in the appraisal of project evaluation techniques.

Verified Answer

Learning Objectives

- Familiarize oneself with the idea of Net Present Value (NPV) and its role in the analysis of projects.

- Understand the basic principles of the Internal Rate of Return (IRR) and Modified Internal Rate of Return (MIRR), along with the distinctions between them.

- Recognize the significance of reinvestment assumptions in the appraisal of project evaluation techniques.

Related questions

If a Project's Modified Internal Rate of Return Is Above ...

You Are Considering a Project with an Initial Outlay of ...

Use the Following Information for the Next Four Questions ...

The Mutually Exclusive Decision Rule for the NPV Technique Is ...

The Internal Rate of Return Is Analogous to the Yield ...