Asked by EZEKIEL LABRADOR on Jun 27, 2024

Verified

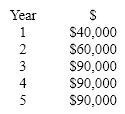

Use the following information for the next four questions. Norlin Corporation is considering an expansion project that will begin next year (Time 0). Norlin's cost of capital is 12%. The initial cost of the project will be $250,000, and it is expected to generate the following cash flows over its five-year life:

Cost of Capital

The rate of return that a company must pay to its capital providers, including both debt and equity, to finance its assets.

Expansion Project

A business initiative aimed at increasing the size, reach, or capabilities of the company, often requiring significant capital investment.

- Gain insight into the notion of Net Present Value (NPV) and how it is applied in project evaluation.

- Understand the importance of the cost of capital in analyzing projects and its computation.

Verified Answer

ZK

Zybrea KnightJul 03, 2024

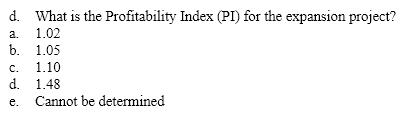

Final Answer :

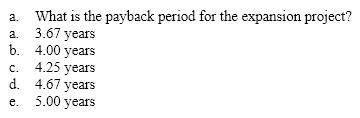

a. a (250 = 40 + 60 + 90 + 60/90; = 3.67 years)

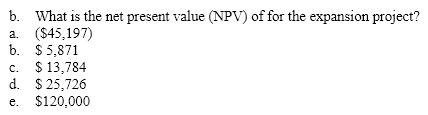

b. b (CFo = -250; C01 = 40; C02 = 60; C03 through C05 = 90; I/Y = 12%; NPV = 5,871)

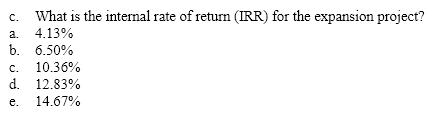

c. d Same as above; IRR = 12.83%

d. a (255,871/250,000 = 1.02)

b. b (CFo = -250; C01 = 40; C02 = 60; C03 through C05 = 90; I/Y = 12%; NPV = 5,871)

c. d Same as above; IRR = 12.83%

d. a (255,871/250,000 = 1.02)

Learning Objectives

- Gain insight into the notion of Net Present Value (NPV) and how it is applied in project evaluation.

- Understand the importance of the cost of capital in analyzing projects and its computation.