Asked by Abigail Martinez on Jul 01, 2024

Verified

What is the net operating income for the month under absorption costing?

A) $7,000

B) $4,600

C) $11,600

D) $24,200

Net Operating Income

A measure of a company's profitability from its core business operations, excluding deductions of interest and taxes.

Absorption Costing

A costing method that includes all manufacturing costs - both fixed and variable - in the cost of a product.

- Digest the concept of absorption costing along with the calculation mechanism.

- Assess and clarify the net operating income with the use of variable and absorption costing strategies.

Verified Answer

ZK

Zybrea KnightJul 06, 2024

Final Answer :

B

Explanation :

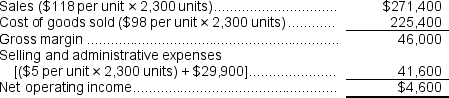

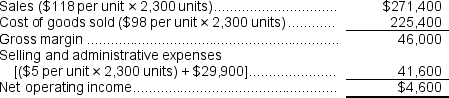

Under absorption costing, fixed manufacturing overhead costs are included in the cost of goods sold. Therefore, net operating income is calculated as follows:

Sales - Cost of goods sold (which includes fixed manufacturing overhead) - Selling and administrative expenses = Net operating income

$30,000 - $15,000 - $10,400 = $4,600.

The correct answer is B.

Sales - Cost of goods sold (which includes fixed manufacturing overhead) - Selling and administrative expenses = Net operating income

$30,000 - $15,000 - $10,400 = $4,600.

The correct answer is B.

Explanation :

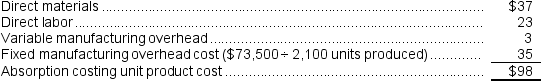

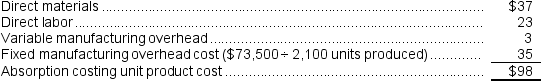

Unit product cost under absorption costing:

Reference: CHO7-Ref18

Reference: CHO7-Ref18

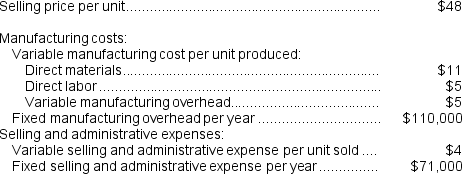

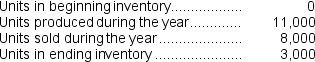

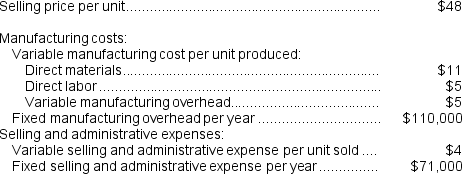

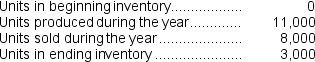

Wolanski Corporation has provided the following data for its most recent year of operations:

Reference: CHO7-Ref18

Reference: CHO7-Ref18Wolanski Corporation has provided the following data for its most recent year of operations:

Learning Objectives

- Digest the concept of absorption costing along with the calculation mechanism.

- Assess and clarify the net operating income with the use of variable and absorption costing strategies.