Asked by shivangi thakur on May 30, 2024

Verified

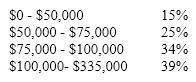

What is the corporate tax paid by a firm with taxable income of $300,000, given the following tax tables.

Corporate Tax

A tax imposed on the income or profit of corporations and other business entities by the government.

Taxable Income

The amount of individual or corporate income upon which the tax authorities levy taxes, after all deductions and exemptions.

- Comprehend the configuration and consequences of tax rates for both corporations and individuals.

Verified Answer

AT

April TennantMay 31, 2024

Final Answer :

($50,000 × 0.15) + ($25,000 × 0.25) + ($25,000 × 0.34) + ($200,000 × 0.39) =

$7,500 + $6,250 + $8,500 + $78,000 = $100,250

$7,500 + $6,250 + $8,500 + $78,000 = $100,250

Learning Objectives

- Comprehend the configuration and consequences of tax rates for both corporations and individuals.