Asked by Stephan Polit on May 02, 2024

Verified

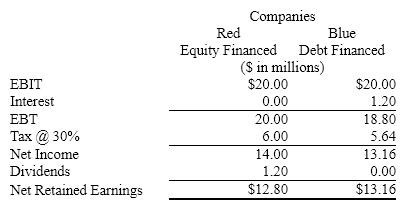

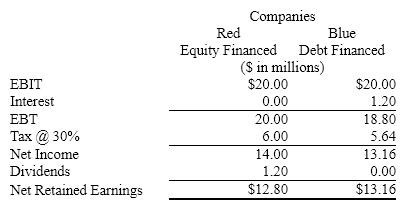

Red and Blue have EBIT of $20.0M and pay tax at a flat rate of 30%. Red is equity financed and pays $1.2M in dividends while Blue is debt financed and pays 1.2M in interest. How much will each company add to its retained earnings for the year. Explain the difference.

Equity Financed

The method of raising capital through the sale of shares in a company.

Retained Earnings

The portion of a company’s profit that is held back and not distributed to shareholders as dividends, to be reinvested in the business.

EBIT

Earnings Before Interest and Taxes - an indicator of a company's profitability that calculates income without tax expenses and interest expenses.

- Gain insight into the framework and ramifications of individual and corporate tax rates.

- Gain insight into the reflection of a company’s economic condition through its financial statements, specifically looking at equity, net income, and net working capital.

Verified Answer

ZK

Zybrea KnightMay 04, 2024

Final Answer :  Blue is able to retain more because its interest payment to debt investors is tax deductible while Red's dividend payment to equity investors is not.

Blue is able to retain more because its interest payment to debt investors is tax deductible while Red's dividend payment to equity investors is not.

Blue is able to retain more because its interest payment to debt investors is tax deductible while Red's dividend payment to equity investors is not.

Blue is able to retain more because its interest payment to debt investors is tax deductible while Red's dividend payment to equity investors is not.

Learning Objectives

- Gain insight into the framework and ramifications of individual and corporate tax rates.

- Gain insight into the reflection of a company’s economic condition through its financial statements, specifically looking at equity, net income, and net working capital.