Asked by Chasity Fields on Jul 11, 2024

Verified

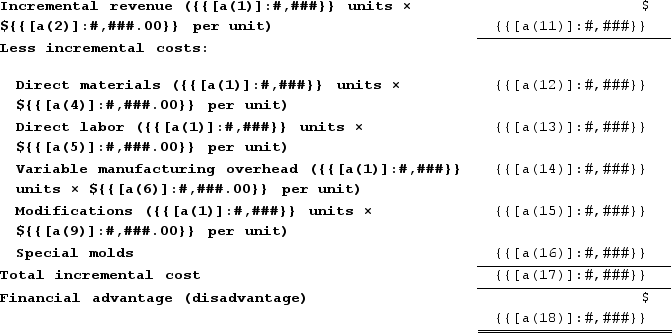

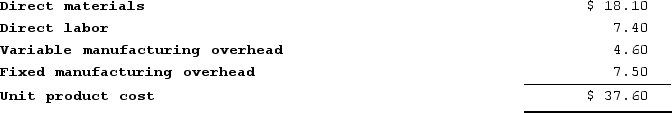

Wehrs Corporation has received a request for a special order of 9,800 units of product K19 for $47.30 each. The normal selling price of this product is $52.40 each, but the units would need to be modified slightly for the customer. The normal unit product cost of product K19 is computed as follows:

Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product K19 that would increase the variable costs by $7.00 per unit and that would require a one-time investment of $46,800 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order.Required:Determine the effect on the company's total net operating income of accepting the special order.

Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product K19 that would increase the variable costs by $7.00 per unit and that would require a one-time investment of $46,800 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order.Required:Determine the effect on the company's total net operating income of accepting the special order.

Special Order

A customer request for a product or service that is not normally offered by the business, often requiring unique production or procurement efforts.

Selling Price

The amount of money charged for a product or service, or the sum of the cost plus profit.

Variable Costs

Expenses that change in proportion to the production output or sales amount.

- Identify the importance of cost and benefit considerations in make-or-buy and special order decision-making processes.

- Examine how special orders influence net operating income, with an analysis that includes variable costs, fixed costs, and capacity considerations.

- Determine the financial impact of accepting a special order by considering modification costs and potential benefits.

Verified Answer

SS

Learning Objectives

- Identify the importance of cost and benefit considerations in make-or-buy and special order decision-making processes.

- Examine how special orders influence net operating income, with an analysis that includes variable costs, fixed costs, and capacity considerations.

- Determine the financial impact of accepting a special order by considering modification costs and potential benefits.