Asked by Samantha Matias on Jul 21, 2024

Verified

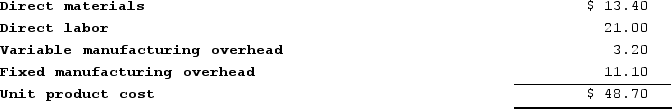

Foto Company makes 12,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows:

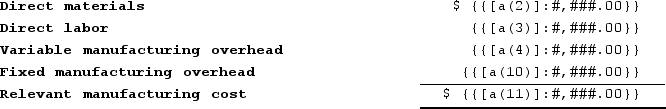

An outside supplier has offered to sell the company all of these parts it needs for $42.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $37,200 per year.If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $6.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.Required:a. How much of the unit product cost of $48.70 is relevant in the decision of whether to make or buy the part? (Round "Per Unit" to 2 decimal places.)b. What is the financial advantage (disadvantage) of purchasing the part rather than making it?c. What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 12,000 units required each year? (Round "Per Unit" to 2 decimal places.)

An outside supplier has offered to sell the company all of these parts it needs for $42.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $37,200 per year.If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $6.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.Required:a. How much of the unit product cost of $48.70 is relevant in the decision of whether to make or buy the part? (Round "Per Unit" to 2 decimal places.)b. What is the financial advantage (disadvantage) of purchasing the part rather than making it?c. What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 12,000 units required each year? (Round "Per Unit" to 2 decimal places.)

Outside Supplier

An outside supplier is an external entity that provides goods or services to a company, typically not affiliated with the company’s internal supply chain.

Fixed Manufacturing Overhead

Costs related to the production process that do not change with the volume of production, such as salaries of manufacturing supervisors and rent for the factory.

Direct Labor

The wages and other costs for labor directly involved in the production of goods.

- Analyze the profitability of continuing with a current production operation versus outsourcing.

- Determine the relevance of costs and benefits in make-or-buy and special order decisions.

Verified Answer

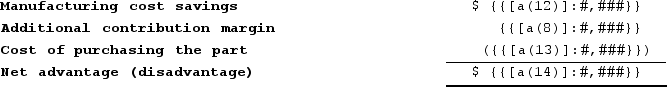

b. Net advantage (disadvantage):

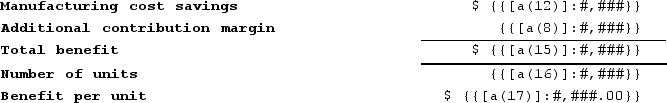

b. Net advantage (disadvantage): c. Maximum acceptable purchase price:

c. Maximum acceptable purchase price:

Learning Objectives

- Analyze the profitability of continuing with a current production operation versus outsourcing.

- Determine the relevance of costs and benefits in make-or-buy and special order decisions.

Related questions

Recher Corporation Uses Part Q89 in One of Its Products ...

Wehrs Corporation Has Received a Request for a Special Order ...

If Melbourne Decides to Purchase the Subcomponent from the Outside ...

What Is the Financial Advantage (Disadvantage)of Purchasing the Part Rather ...

If Management Decides to Buy Part U98 from the Outside ...