Asked by Christa Preville on Jul 15, 2024

Verified

Watson purchased one-half of Dalton's interest in the Patton and Dalton Partnership for $45,000. Prior to the investment, land was revalued to a market value of $135,000 from a book value of $93,000. Patton and Dalton share net income equally. Dalton had a capital balance of $35,000 prior to these transactions.Required

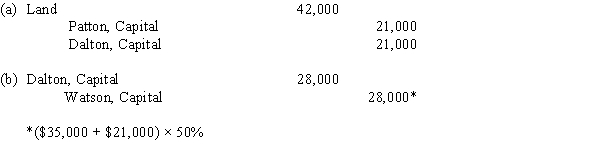

(a) Provide the journal entry for the revaluation of land.

(b) Provide the journal entry to admit Watson.

Market Value

The existing market rate at which you can purchase or sell an asset or service.

Book Value

The value of an asset as shown on a company's balance sheet, calculated as the cost of the asset minus any depreciation and amortization.

Capital Balance

The amount of funds contributed by owners or shareholders to a business, plus retained earnings and reduced by any withdrawals or distributions.

- Practice journalization methods for the inclusion of a new partner in a partnership entity.

- Assess the monetary repercussions of re-assessing asset worth in a collaborative business environment.

Verified Answer

Learning Objectives

- Practice journalization methods for the inclusion of a new partner in a partnership entity.

- Assess the monetary repercussions of re-assessing asset worth in a collaborative business environment.

Related questions

Brad Simmons, Sole Proprietor of a Hardware Business, Decides to ...

The Capital Accounts of Hope and Indiana Have Balances of ...

Kala and Leah, Partners in Best Designs, Have Capital Balances ...

Gentry, Sole Proprietor of a Hardware Business, Decides to Form ...

Juanita Gomez and Brandi Toomey Have Formed the GT Partnership ...