Asked by Lawrence Woods on Jun 03, 2024

Verified

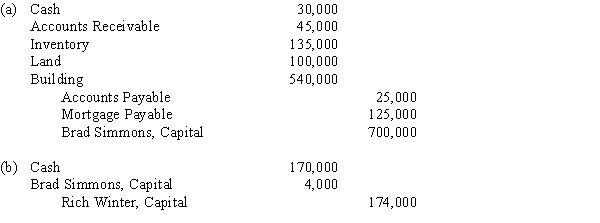

Brad Simmons, sole proprietor of a hardware business, decides to form a partnership with Rich Winter. Brad's accounts are as follows: Book Value Market Value Cash $30,000$30,000 Accounts Receivable (net) 55,00045,000 Inventory 112,000135,000 Land 40,000100,000 Buil ding (net) 500,000540,000 Accounts Payable 25,00025,000 Mortgage Payable 125,000125,000\begin{array}{lrr} & \text { Book Value } & \text { Market Value } \\\text { Cash } & \$ 30,000 & \$ 30,000 \\\text { Accounts Receivable (net) } & 55,000 & 45,000 \\\text { Inventory } & 112,000 & 135,000 \\\text { Land } & 40,000 & 100,000 \\\text { Buil ding (net) } & 500,000 & 540,000 \\\text { Accounts Payable } & 25,000 & 25,000 \\\text { Mortgage Payable } & 125,000 & 125,000\end{array} Cash Accounts Receivable (net) Inventory Land Buil ding (net) Accounts Payable Mortgage Payable Book Value $30,00055,000112,00040,000500,00025,000125,000 Market Value $30,00045,000135,000100,000540,00025,000125,000 Rich agrees to contribute $170,000 for a 20% interest. Journalize the entries to record

(a) Brad's investment and

(b) Rich's investment.

Market Value

The current price at which an asset or service can be bought or sold in the market.

Book Value

The value of a company or asset according to its financial statements, calculated by taking the total assets minus the liabilities and intangible assets.

Mortgage Payable

A liability account on the balance sheet representing the amount owed to a lender for property purchased.

- Execute journal entry strategies for the integration of a new partner into a partnership.

- Analyze the consequences of changes in the makeup of partnerships on the balances of capital and ownership rights.

Verified Answer

Learning Objectives

- Execute journal entry strategies for the integration of a new partner into a partnership.

- Analyze the consequences of changes in the makeup of partnerships on the balances of capital and ownership rights.

Related questions

Watson Purchased One-Half of Dalton's Interest in the Patton and ...

The Capital Accounts of Hope and Indiana Have Balances of ...

Kala and Leah, Partners in Best Designs, Have Capital Balances ...

Gentry, Sole Proprietor of a Hardware Business, Decides to Form ...

When a New Partner Is Admitted to a Partnership, All ...