Asked by Aashma Bista on Jul 08, 2024

Verified

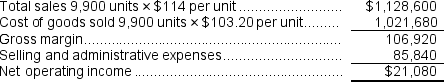

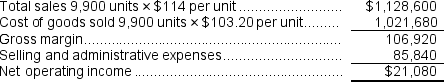

Wasilko Corporation produces and sells one product. a.The budgeted selling price per unit is $114.Budgeted unit sales for February is 9,900 units.

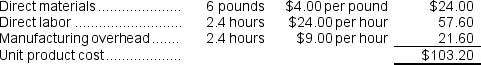

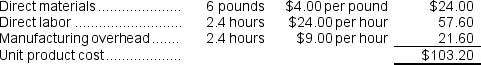

B.Each unit of finished goods requires 6 pounds of raw materials.The raw materials cost $4.00 per pound.

C.The direct labor wage rate is $24.00 per hour.Each unit of finished goods requires 2.4 direct labor-hours.

D.Manufacturing overhead is entirely variable and is $9.00 per direct labor-hour.

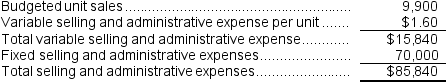

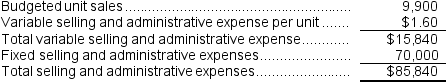

E.The variable selling and administrative expense per unit sold is $1.60.The fixed selling and administrative expense per month is $70,000.

The estimated net operating income (loss) for February is closest to:

A) $50,000

B) $91,080

C) $21,080

D) $36,920

Direct Labor-Hours

The amount of time spent by workers directly involved in manufacturing a product or delivering a service.

Raw Materials

The basic substances in their natural, modified, or semi-processed states used as inputs for manufacturing processes.

- Evaluate and calculate the net operating income from various budget projections.

Verified Answer

IM

Irene MoralesJul 15, 2024

Final Answer :

C

Explanation :

The estimated unit product cost is computed as follows:  The estimated selling and administrative expense for February is computed as follows:

The estimated selling and administrative expense for February is computed as follows:  The estimated net operating income for February is computed as follows:

The estimated net operating income for February is computed as follows:

The estimated selling and administrative expense for February is computed as follows:

The estimated selling and administrative expense for February is computed as follows:  The estimated net operating income for February is computed as follows:

The estimated net operating income for February is computed as follows:

Learning Objectives

- Evaluate and calculate the net operating income from various budget projections.

Related questions

Knappert Corporation Makes One Product and Has Provided the Following ...

Which of the Following Transactions Will Result in an Increase ...

The Net Operating Income in the Flexible Budget for January ...

Gordin Kennel Uses Tenant-Days as Its Measure of Activity; an ...

Neeb Corporation Manufactures and Sells a Single Product ...