Asked by terrence showers on Jul 29, 2024

Verified

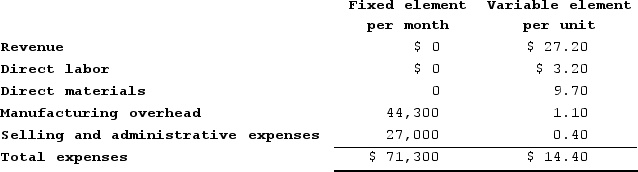

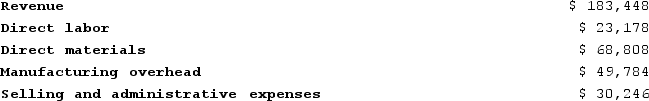

Neeb Corporation manufactures and sells a single product. The company uses units as the measure of activity in its budgets and performance reports. During January, the company budgeted for 7,000 units, but its actual level of activity was 7,040 units. The company has provided the following data concerning the formulas used in its budgeting and its actual results for January:Data used in budgeting:  Actual results for January:

Actual results for January:

The manufacturing overhead in the flexible budget for January would be closest to:

The manufacturing overhead in the flexible budget for January would be closest to:

A) $49,501

B) $52,000

C) $52,044

D) $50,068

Manufacturing Overhead

refers to indirect factory-related costs incurred when producing a product, which can include costs related to the maintenance and operation of the factory.

Flexible Budget

A budget that adjusts or flexes with changes in volume or activity, allowing more accurate budgeting in variable cost situations.

Units

A quantifiable measure used in manufacturing, inventory, and other sectors, referring to the individual or standardized quantity of a product or material.

- Ascertain and elucidate the net operating income utilizing flexible and planning budgets.

Verified Answer

Manufacturing Overhead = Budgeted Variable Overhead Rate x Actual Activity Level + Fixed Overhead

In this case, the budgeted variable overhead rate is $6 per unit (direct materials + direct labor + variable overhead). The actual activity level is 7,040 units. Using these values and the fixed overhead of $25,724, we can calculate the manufacturing overhead in the flexible budget for January as follows:

Manufacturing Overhead = $6 x 7,040 + $25,724

Manufacturing Overhead = $42,240 + $25,724

Manufacturing Overhead = $67,964

Therefore, the manufacturing overhead in the flexible budget for January would be closest to $52,044 (option C).

Learning Objectives

- Ascertain and elucidate the net operating income utilizing flexible and planning budgets.

Related questions

Paulis Kennel Uses Tenant-Days as Its Measure of Activity; an ...

Manter Corporation Manufactures and Sells a Single Product ...

Meinke Kennel Uses Tenant-Days as Its Measure of Activity; an ...

Meinke Kennel Uses Tenant-Days as Its Measure of Activity; an ...

Gordin Kennel Uses Tenant-Days as Its Measure of Activity; an ...