Asked by Emily Esparza on Jun 16, 2024

Verified

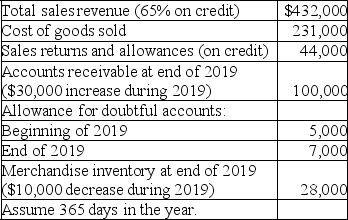

Walkers World Company gathered the following information for 2019:

Calculate each of the following ratios.Round all dollar amounts to whole dollars and all other calculations to two decimal places.

Calculate each of the following ratios.Round all dollar amounts to whole dollars and all other calculations to two decimal places.

A.Receivable turnover ratio

B.Average days to collect receivables

C.Inventory turnover ratio

D.Average number of days to sell inventory

Receivable Turnover Ratio

A financial metric used to measure how efficiently a company uses its assets by calculating how many times a company can turn its accounts receivable into cash within a period.

Inventory Turnover Ratio

The inventory turnover ratio measures how many times a company's inventory is sold and replaced over a period.

Average Days

An accounting measure used to calculate the average number of days taken for a company to collect cash from its customers or pay its debts.

- Exhibit the capability to calculate and understand end-of-period financial ratios using provided information, such as turnover and average days ratios.

Verified Answer

UC

Ulises CarrenoJun 19, 2024

Final Answer :

A.Receivable turnover ratio = [($432,000 × 65%)- $44,000] ÷ [($100,000 - $7,000)+ ($70,000 - $5,000)/2] = 3.0.

B.Average days to collect receivables = 365 days ÷ 3 = 121.67 average days' to collect.

C.Inventory turnover ratio = $231,000 ÷ [($28,000 + $38,000)/2] = 7 times.

D.Average number of days to sell inventory = 365 days ÷ 7 = 52.14 average number of days to sell inventory.

B.Average days to collect receivables = 365 days ÷ 3 = 121.67 average days' to collect.

C.Inventory turnover ratio = $231,000 ÷ [($28,000 + $38,000)/2] = 7 times.

D.Average number of days to sell inventory = 365 days ÷ 7 = 52.14 average number of days to sell inventory.

Learning Objectives

- Exhibit the capability to calculate and understand end-of-period financial ratios using provided information, such as turnover and average days ratios.