Asked by Brittany Hoffman on May 03, 2024

Verified

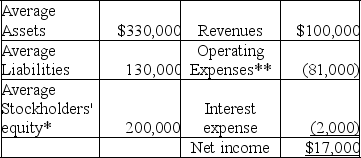

The records of Washington Company showed the following:

*10,000 shares outstanding at 1/1 and at 12/31;current market price,$30

*10,000 shares outstanding at 1/1 and at 12/31;current market price,$30

**Including income tax;income tax rate is 30%

Calculate each of the following ratios:

A.Return on assets

B.Return on equity

C.Net profit margin

D.Earnings per share

Return on Assets

A profitability ratio indicating the efficiency with which a company uses its assets to generate net income, calculated by dividing net income by total assets.

Return on Equity

A financial ratio that measures the profitability of a company in relation to shareholders' equity, indicating how effectively equity supports operations and growth.

Earnings Per Share

A measure of a company's profitability calculated by dividing its net income by the number of outstanding shares of its common stock.

- Illustrate the ability to process and decode concluding financial ratios with provided data, covering turnover and average days ratios.

Verified Answer

ZK

Zybrea KnightMay 05, 2024

Final Answer :

A.Return on assets = $17,000 ÷ $330,000 = 5.2%.

B.Return on equity = $17,000 ÷ $200,000 = 8.5%.

C.Net profit margin = 17,000 ÷ $100,000 = 17%.

D.Earnings per share = $17,000 ÷ 10,000 = $1.70.

B.Return on equity = $17,000 ÷ $200,000 = 8.5%.

C.Net profit margin = 17,000 ÷ $100,000 = 17%.

D.Earnings per share = $17,000 ÷ 10,000 = $1.70.

Learning Objectives

- Illustrate the ability to process and decode concluding financial ratios with provided data, covering turnover and average days ratios.