Asked by Araceli Zambrano on May 03, 2024

Verified

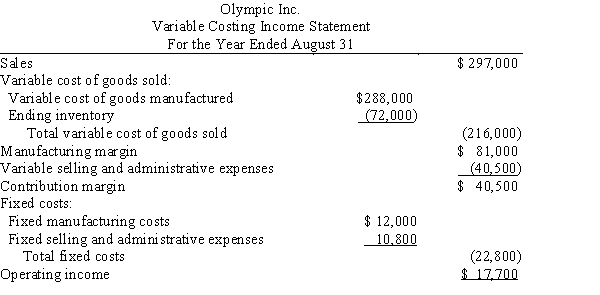

During the first year of operations, 18,000 units were manufactured and 13,500 units were sold. On August 31, Olympic Inc. prepared the following income statement based on the variable costing concept:  Determine the unit cost of goods manufactured, based on (a) the variable costing concept and (b) the absorption costing concept.

Determine the unit cost of goods manufactured, based on (a) the variable costing concept and (b) the absorption costing concept.

Variable Costing

An accounting method that includes only variable production costs (direct materials, direct labor, and variable manufacturing overhead) in product costs.

Absorption Costing

A bookkeeping approach that encompasses all production expenses, including both constant and fluctuating costs, in the price of a good.

Unit Cost

The calculated cost assigned to a single unit of product or service, comprising all variable and fixed costs.

- Distinguish between the methodologies of absorption costing and variable costing.

- Examine and construct income statements utilizing absorption as well as variable costing methods.

Verified Answer

DK

Danka KnezevicMay 10, 2024

Final Answer :

a.$16.00 ($288,000 total variable cost of goods manufactured ÷ 18,000 units manufactured)b.Unit variable cost of goods manufactured (a)$16.00

Unit fixed cost of goods manufactured

($12,000 ÷ 18,000 units manufactured)0.67

Unit cost

$16.67

Unit fixed cost of goods manufactured

($12,000 ÷ 18,000 units manufactured)0.67

Unit cost

$16.67

Learning Objectives

- Distinguish between the methodologies of absorption costing and variable costing.

- Examine and construct income statements utilizing absorption as well as variable costing methods.