Asked by Jesse Shiber on May 09, 2024

Verified

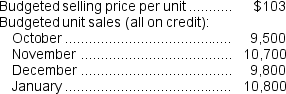

Mumbower Corporation makes one product and has provided the following information to help prepare the master budget for the next four months of operations:

Credit sales are collected:

Credit sales are collected:

40% in the month of the sale

60% in the following month

Raw materials purchases are paid:

40% in the month of purchase

60% in the following month

The ending finished goods inventory should equal 20% of the following month's sales.The ending raw materials inventory should equal 40% of the following month's raw materials production needs.

Required:

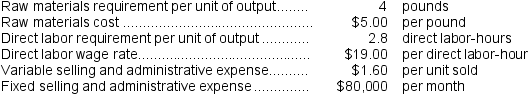

a.What are the budgeted sales for November?

b.What are the expected cash collections for November?

c.What is the budgeted accounts receivable balance at the end of November?

d.According to the production budget, how many units should be produced in November?

e.If 40,000 pounds of raw materials are needed for production in December, how many pounds of raw materials should be purchased in November?

f.What is the estimated cost of raw materials purchases for November?

g.If the cost of raw material purchases in October is $201,040, then in November what are the total estimated cash disbursements for raw materials purchases?

h.What is the estimated accounts payable balance at the end of November?

i.What is the estimated raw materials inventory balance at the end of November?

j.What is the total estimated direct labor cost for November assuming the direct labor workforce is adjusted to match the hours required to produce the forecasted number of units produced?

k.For simplicity, we will assume that there is no fixed manufacturing overhead and that the variable manufacturing overhead is $7.00 per direct labor-hour.What is the estimated unit product cost?

l.What is the estimated finished goods inventory balance at the end of November?

m.What is the estimated cost of goods sold and gross margin for November?

n.What is the estimated total selling and administrative expense for November?

o.What is the estimated net operating income for November?

Master Budget

The master budget is a comprehensive financial planning document that includes all of a company's budgeted financial statements and operating plans for a specific period.

Raw Materials

The basic materials and components used in the production processes of manufacturing goods.

Finished Goods Inventory

The completed products that are ready for sale but have not yet been sold.

- Absorb the essential doctrines and methodologies pertinent to the establishment of a master budget.

- Calculate and interpret budgeted sales, cash collections, and accounts receivable balances.

- Assemble a budget for production, embedding needed unit outputs to reach sales and inventory objectives.

Verified Answer

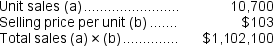

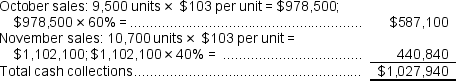

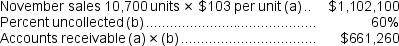

b.The expected cash collections for November are computed as follows:

b.The expected cash collections for November are computed as follows:  c.The budgeted accounts receivable balance at the end of November is:

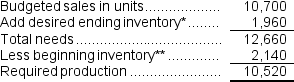

c.The budgeted accounts receivable balance at the end of November is:  d.The budgeted required production for November is computed as follows:

d.The budgeted required production for November is computed as follows:  *December sales of 9,800 units × 20% = 1,960 units

*December sales of 9,800 units × 20% = 1,960 units** November sales of 10,700 units × 20%= 2,140 units

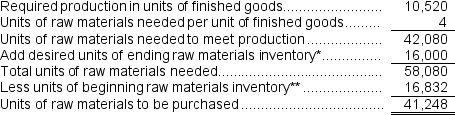

e.The budgeted raw material purchases for November are computed as follows:

* 40,000 pounds × 40% = 16,000 pounds.

* 40,000 pounds × 40% = 16,000 pounds.** 42,080 pounds × 40% = 16,832 pounds.

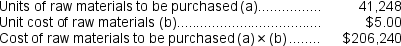

f.The budgeted cost of raw material purchases for November is computed as follows:

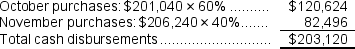

g.The estimated cash disbursements for materials purchases in November is computed as follows:

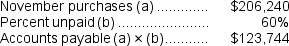

g.The estimated cash disbursements for materials purchases in November is computed as follows:  h.The budgeted accounts payable balance at the end of November is:

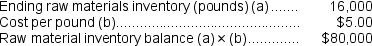

h.The budgeted accounts payable balance at the end of November is:  i.The estimated raw materials inventory balance at the end of November is computed as follows:

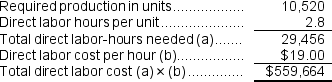

i.The estimated raw materials inventory balance at the end of November is computed as follows:  j.The estimated direct labor cost for November is computed as follows:

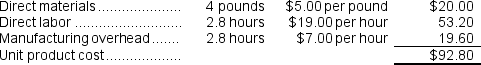

j.The estimated direct labor cost for November is computed as follows:  k.The estimated unit product cost is computed as follows:

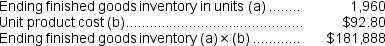

k.The estimated unit product cost is computed as follows:  l.The estimated finished goods inventory balance at the end of November is computed as follows:

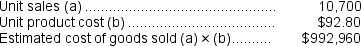

l.The estimated finished goods inventory balance at the end of November is computed as follows:  m.The estimated cost of goods sold for November is computed as follows:

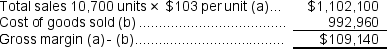

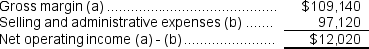

m.The estimated cost of goods sold for November is computed as follows:  The estimated gross margin for November is computed as follows:

The estimated gross margin for November is computed as follows:  n.The estimated selling and administrative expense for November is computed as follows:

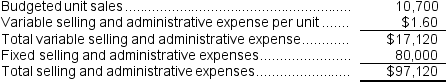

n.The estimated selling and administrative expense for November is computed as follows:  o.The estimated net operating income for November is computed as follows:

o.The estimated net operating income for November is computed as follows:

Learning Objectives

- Absorb the essential doctrines and methodologies pertinent to the establishment of a master budget.

- Calculate and interpret budgeted sales, cash collections, and accounts receivable balances.

- Assemble a budget for production, embedding needed unit outputs to reach sales and inventory objectives.

Related questions

Vinall Corporation Makes One Product and Has Provided the Following ...

Botz Corporation Makes One Product and It Provided the Following ...

If the Company Has Budgeted to Sell 12,000 Yutes in ...

The Excess (Deficiency)of Cash Available Over Disbursements for January Is

Catano Corporation Pays for 40% of Its Raw Materials Purchases ...