Asked by Michael McGuire on Jun 17, 2024

Verified

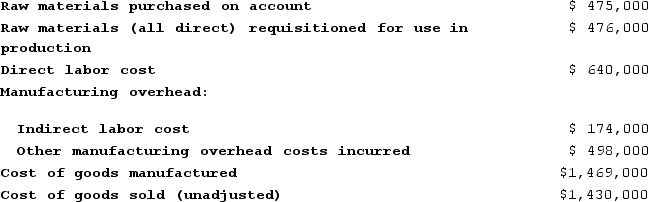

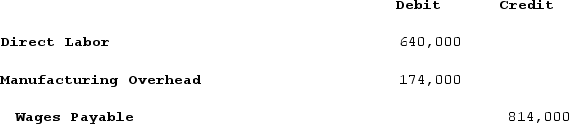

Verrett Corporation is a manufacturer that uses job-order costing. The company has supplied the following data for the just completed year:  What is the journal entry to record the direct and indirect labor costs incurred during the year?

What is the journal entry to record the direct and indirect labor costs incurred during the year?

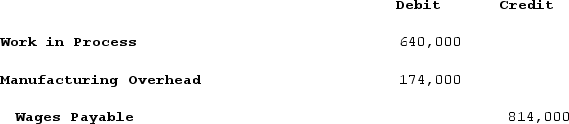

A)

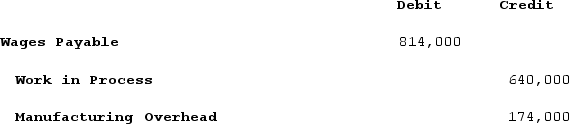

B)

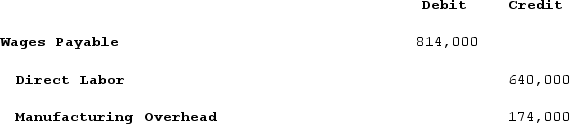

C)

D)

Job-Order Costing

An accounting method that tracks costs individually for each job, suitable for companies that produce custom products or services.

Direct Labor Costs

Expenses that are directly tied to the production of goods or services, including wages of workers who can be directly traced to the product.

Indirect Labor Costs

Labor costs associated with employees who do not directly work on the production of products or services, such as maintenance staff or supervisors.

- Determine the appropriate handling of direct and indirect materials in a manufacturing process.

Verified Answer

Learning Objectives

- Determine the appropriate handling of direct and indirect materials in a manufacturing process.

Related questions

On January 1, Schaf Corporation Had $23,000 of Raw Materials ...

Watson Company Has the Following Data: Determine the Amount ...

When a Process Cost Accounting System Records the Purchase of ...

A Firm Produces Its Products by a Continuous Process Involving ...

Fast-Flow Paints Produces Mixer Base Paint Through a Two-Stage Process ...